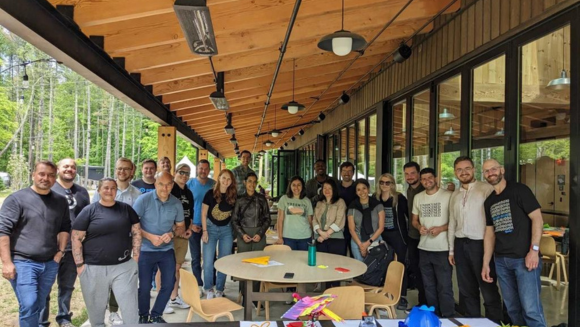

Business Building Experts

We put serious skin in the game to make your company better. We’ve pioneered an "open-source" investing model where we profit-share with experts in the Underscore Core Community that support the startups we back. By sharing a piece of the pie with our broader ecosystem, we’ve created a uniquely collaborative model that is truly aligned with our founders.

Dries Buytaert

Founder of Acquia & DrupalDries is the original creator and project lead for the Drupal open source web publishing and collaboration platform. He is also Co-founder and CTO of Acquia. As a supporter of Underscore VC from day one, Dries served as a Core Partner to two of our firm’s very first investments: Moltin & Mautic.

Corey Thomas

Chairman & CEO of Rapid7Corey is the CEO of Rapid7, as well as the chairman of its board of directors. He serves on the National Security Telecommunications Advisory Committee (NSTAC) and is elected chair of the Federal Reserve Bank of Boston. Corey is a CloudZero Core Partner. Learn more about his involvement with CloudZero here.

Maria Loughlin

Former SVP of Engineering at ToastMaria is a tech executive and advisor to technology startups. She previously served as SVP of Engineering at Toast and is an Underscore VC Core Limited Partner and a Core Partner to Mable. Read more here.

Meghan Verena Joyce

CEO of DuckbillMeghan is a former Uber and Oscar Health executive. Today she is the Founder and CEO of Duckbill and an Underscore VC Core Limited Partner. Learn more about Meghan via her Core Summit session recording.

Steve Fredette

Co-Founder of ToastSteve is the President and Co-founder of Toast, where he leads product and innovation initiatives. Prior to Toast, he worked on mobile app development before the iPhone came out, creating the first Flickr and Shoebuy.com apps. He is an Underscore VC Core Limited Partner.

Andy Palmer

Co-Founder of TamrAndy is a seasoned entrepreneur with over 30 years of experience in building and scaling innovative companies in the fields of technology, health care, and life sciences. He is the Co-founder of Tamr, and Underscore VC Core Limited Partner, and a Core Partner to Trove Health.

Amy Villeneuve

Board Director, Advisor & Past COO and President of Amazon RoboticsAmy is a board director, advisor, and the past COO and President of Amazon Robotics. She is an active Core Member with broad expertise in corporate strategy creation, scaling businesses, building and inspiring leadership teams, and M&A integration.

Your Early-Stage Partner in Boston

Underscore invests in B2B software startups globally and serves as their link to one of the greatest innovation hubs in the world: Boston.

Recent News

- TetraScience Partners with Google Cloud to Catalyze Scientific AI Innovation

- Underscore VC Closes 3rd Fund as the Firm Completes a Generational Transfer | Fortune

- Meet Boston’s New Power Venture Capitalist | Business Insider

- Brian Devaney Named to 2023 EVC List, Recognizing Top 25 Emerging Stars in VC

- Kard, Lendflow, and Pagos earn spots on the 2024 #FintechInnovation50