In the tech industry, it’s not uncommon for entrepreneurs to become so singularly focused on the novelty of their product that they forget to innovate sufficiently around their business model. A disruptive business model can be at least as critical as discontinuous innovation.

In this video, Underscore VC Partner Lily Lyman shares some more context on what investors look for in a business model at the Seed stage.

From an investor’s perspective, the perfect scenario is:

- A discontinuous innovation

- Wrapped in a disruptive business model

- Targeting a significant new market opportunity or underserved target segment

- Where there is real pain and need.

That’s the perfect storm.

But too often, the business model is left to the end, as an afterthought. Of course, as market observers, we’ve heard countless examples of superior products that failed to capitalize on the market opportunity that was their due. We’re almost conditioned to understand the implications of this. Still, the problem persists as business models fail to generate the attention they deserve.

Here’s a simple framework of three initial steps to take:

1. Disrupt and Create a Dilemma

Don’t simply recycle someone else’s business model. That’s squandering an opportunity to change the game by defining new rules in your favor. In redefining a category, your overarching goal should be to cause someone else to have an innovator’s dilemma. Take the conventional and look at its inverse. Turn established business models inside out. You rarely win by following the pack, so figure out where the incumbents are vulnerable and exploit that as the basis for taking market leadership.

For example, Google gives away tools with powerful utility because their interest isn’t selling technology; it’s collecting data as the basis for an advertising business model. This has been highly disruptive to players like Microsoft whose original business model was licensing software. Facebook is repeating this model, disrupting other online players who can’t compete with “free” and even “better” as they collect rich data profiles to monetize.

2. Identify Your CORE Differentiation

As you think through how you can disrupt the status quo, do so by identifying your Capabilities Of Really Exceptional (CORE) value. What is it is that makes you exceptionally valuable? Think hard about this one. It’s the foundation upon which you’ll build your business model. Is it software? Services? Or perhaps it’s data or content generated by your community or even a process you’ve crafted?

For Facebook, it’s data. For Yelp, it’s user-generated content. Perhaps like Red Hat or Acquia, you’re selling services on top of open-source software. Identify your core value, why it’s profoundly better than incumbents or alternatives, and, finally, how you’ll monetize and use it as a competitive weapon for an unfair advantage.

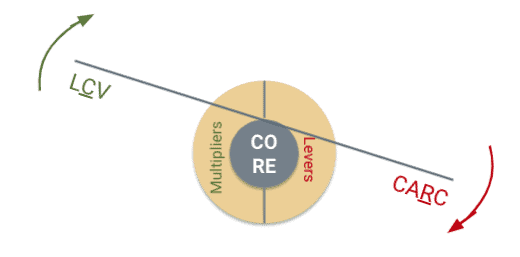

3. Use Multipliers and Levers Around Your CORE

Once you’ve defined your core, identify multipliers and levers to help accelerate and economize the proliferation of your value proposition.

Multipliers for Rapid Market Expansion

Multipliers help you drive revenue, reach, and coverage, which is vitally important when you consider amortizing and then profiting beyond the cost of customer acquisition. Take a close look at the P&L of a traditional software company and you’ll notice something potentially surprising: On average, sales and marketing expenses are 2X research and development in a steady-state model.

That’s why it’s so important to find multipliers that will help you drive revenue at the lowest possible cost. Examples of this include freemium or tiered pricing models that allow you to seed the market with a low- or no-cost offering as the basis for paid conversion over time.

As one basis for making products more digestible and achieving tiered pricing, try using a technique called “Russian doll packaging.” Here, your base product is free or nearly so to encourage viral adoption. As you build a community around the free version, you can convert to paid usage by upselling and cross-selling paid “editions” layered on top of the free version.

Aligning with well-established technology stacks can also become a multiplier when you’re filling a conspicuous gap in a high value and acknowledged way. It not only can complete a “whole product,” but done correctly, this sort of strategic alignment can create a dramatic pull in the market, putting you in a position for multiplied growth.

Underpinning all of this is the necessity for “SLIPPERY products”: Simple, Low or no initial cost, Installs easily, Proves value quickly, Plays well with others, Easy to use, ROI is obvious, Your customers can’t live without it. Slippery products grease the skids for end-user adoption, which can dramatically reduce customer acquisition and retention costs.

Levers to Drive Down Costs

Levers help you reduce time, cost, and resources to deliver your value proposition. Open-source and other co-creation models are great examples of leveraged business models. Here, you sell value, often in the form of services, support, and perhaps commercial add-on products, on top of a core product that is built and maintained by the community.

Red Hat is the classic example of a company that has built a franchise around the Linux open-source community and a billion-dollar business around this model. Acquia is following a similar path around Drupal open source community and, with cloud services as their multiplier, in the social publishing space.

Crowdsourcing is another great example. For example, Applause is a company that has leveraged crowds effectively by mobilizing a global community to execute a mobile application test matrix of such combinatorial complexity that it would have been economically infeasible otherwise.

From the perspective of demand generation, viral, inbound, and social marketing has changed the game altogether by shifting the economics of marketing through an inversion of the model from push to pull, and therefore outbound to inbound, making marketing more cost-effective and powerful when executed well.

Working Together

Of course, the real magic is getting multipliers and levers to work together, where multipliers like freemium models also provide leveraged selling value through a community of free users who see value in conversion to paid usage tiers. Your community becomes your pipeline.

By thinking through the three aspects of business model creation—identifying your CORE value, finding multipliers for growth and levers for cost economies—you’ll have much better odds of building a company that returns value disproportionally to all of its stakeholders.