Grocery is undergoing massive digital transformation.

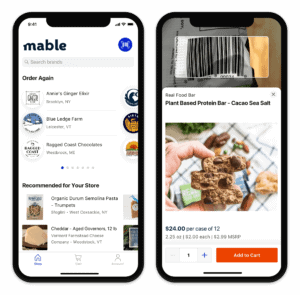

As part of that transformation, we are excited to announce our investment behind Mable, a B2B eCommerce marketplace that connects grocery store buyers, retailers, and brands. Mable enables grocery store buyers to easily order anything in one place, allows distributors to provide a modern purchasing experience for their retailers, and shares new insights with brands that sell through these channels.

With $8.5M in fresh Series A capital from strong co-investors such as Venrock, Accomplice, and Founder Collective, Mable is poised to change the way the $641B grocery market does its wholesale ordering.

The Status Quo Is Painful

Grocery store employees spend countless hours managing re-orders from an array of distributors and brands. Placing these orders via phone, text, or email makes managing these purchases incredibly labor-intensive. On the other side, distributors are flooded with orders.

The team behind Mable has transformed this onerous, antiquated process into a vertical-specific B2B eCommerce marketplace that links retailers, distributors, and brands.

Why Did Underscore VC Invest in Mable?

We were fortunate to meet Mable’s Founder and CEO, Arik Keller, as part of our Product Core, and we closely followed the team as they built their early product. As a Boston-based, Series A investor with Commerce, Supply Chain, FinTech, and Marketplace expertise, we knew Mable would be a strong firm fit. So when it came time for the team to raise their Series A, we were eager to invest. Here’s why:

Uniquely Qualified Team & Founder-Market Fit

Arik’s inspiration for launching Mable came from his own lived experience. While running a grocery store in Vermont, he saw the inefficiency of inventory purchasing. As a result, he deeply understands his target customers’ pain points. Moreover, he knows a thing or two about building successful businesses. He is a seasoned technology entrepreneur with three successful exits to Facebook, Paypal, and Solarwinds.

Plus, Arik’s ability to recognize, attract, and land great talent—and his willingness to surround himself with a leadership team built for scale—make him an incredibly appealing founder. One of these leaders is Lucy He, a strong VP of Product who has worked with Arik for eight years in product management leadership roles at startups such as Zynga, Kyruus, and GasBuddy, as well as at Paypal.

Underserved, Yet Significant Vertical Market with Network Effects

The market size for Mable is not apparent at first blush. How could serving a fragmented set of small grocers that do $2-5M in annual revenue make for a great business? By connecting the entire supply chain. Mable provides the software defined network that links brands, distributors, and retailer stores.

Independent grocers are usually family-owned and aren’t considered to be large supermarket operators. But taken collectively, they account for 25% of retail grocery sales, with 21,000 stores bringing in $131B in annual sales (or 1% of the entire US GDP). In fact, as a collective, they are the biggest “grocer” when it comes to store locations/units. While the smallest of these stores often do less than $2M in revenue annually, they spend 70% of that, or $1.4M, on inventory purchases.

Meanwhile, the distributors that service these retailers are expected to transform with modern purchasing solutions. But beyond servicing distributors up the chain, we can further verticalize the opportunity down the chain, taking the established footprint and creating operational vertical-specific software and embedding FinTech offerings, such as POS, payroll, or inventory financing at the store level, or backing up into the supply chain for distributor or brand-specific wholesale coordination software. Moreover, the moat for the business not only comes from the installed footprint, but also re-enforcing network effects with a growing set of distributors and brand content on the platform. There is a category to be created for this specific vertical.

Validated “Initial Hook” Pain Point

Supplier management and re-ordering are grocers’ most significant, unsolved pain points, as validated across many customer conversations. Beyond spending 70% of revenue on inventory purchases, grocers spend 25% of their time in procurement and replenishment. By targeting grocers’ biggest cost center—inventory and supplier coordination—Mable tackles a systemic pain point that existing storefront POS or distributor systems don’t yet address. Currently, the best alternative includes logging into a bunch of varied distributor portals (at best) or calling, faxing, and emailing (at worst) for each product on the shelf. Mable provides a single place for re-ordering across distributors and brands. Shopkeepers’ eyes light up when you talk about this possibility.

Leverage in Go-to-Market

Going after a fragmented customer base with smaller customer price points is a difficult equation, unless you can unlock leverage in the go-to-market motion. Fortunately, distributors to retail stores are being asked for software they cannot deliver (and they worry their competitors might introduce it first). Mable can provide an eCommerce experience for all the stores that distributors serve. Accessing and growing lifetime value with retailers, while finding leverage in go-to-market customer acquisition cost, is essential. And Mable has proven they can do it.

Want to Learn More About Mable?

Mable is growing their team (check out the open roles) as the company continues to add to its list of delighted customers. We couldn’t be more excited to partner with the Mable team in the coming years, and we’re thrilled to be on this journey together!