We are proud to announce our follow-on investment in Messari, the leading crypto data aggregator and research platform. Messari provides reliable market intelligence for crypto investors and professionals so that they can make better decisions.

As investors in Messari across both the Pre-Seed and Seed rounds, we are thrilled to welcome new Series A investor Point72 Ventures alongside other existing early backers for a $21M round. Early backers include Coinbase Ventures, Alameda Research, Blockchain Ventures, Galaxy Digital, Gemini Frontier Fund, Kraken Ventures, and Anchorage’s Diogo Monica; along with several other top crypto funds: CMS Holdings and Nascent.

This post discusses why we invested (again) behind the founder of Messari, and what it means for the future of the crypto-asset category.

Investing Founder First

Investing at the earliest stages of companies is in some ways difficult and in some ways easy. We always say, everything changes (market, customers, product, etc), except the team — which is why this was an easy investment choice for us years ago, and still today.

We’re fortunate to have known Messari’s Founder & CEO, Ryan Selkis, for several years prior to Messari’s inception. He was the Managing Director at CoinDesk for three years and grew the web property to be one of the largest and most influential in the space. He had also been part of the founding team at the Digital Currency Group (a multi-billion dollar investment company and media holding property). Ryan has been in this industry for 7+ years (and as part of our Core Community at Underscore for 4+ years), making him one of the longest-tenured professionals in the space, which is in part reflected in his 100k+ Twitter following.

Just ahead of this financing, we sat down with Ryan to find out why they have so much faith in this company and category and what the future is going to look like. Watch the full conversation here:

One of the most interesting parts of that interview is why this market has accelerated and how Messari is positioning into the future, which is central to our basis for investing behind the team going forward.

Why Now: Accelerating At The Right Moment

After a sleepy few years, the crypto market has turned on in 2021 and is having a moment as a result of the unprecedented central bank money printing across the world due to the COVID pandemic. Crypto assets and decentralized finance (DeFi) have become an attractive asset class with potentially high returns, and as an inflation hedge in this environment. As such, the potential customer base for Messari has expanded rapidly, to create a “why now” moment for this company and asset class.

Institutional investors around the world have just begun to pay attention to the previously niche asset class ー and are looking for a data product that covers the breadth of the space. This new critical mass in a new audience of institutional investors is large (think: Fidelity Investments, JP Morgan, Citibank, and Goldman Sachs). Moreover, university endowment funds at Harvard, Yale, Brown, and others have been buying bitcoin directly on various exchanges for the past year, as are leading hedge fund managers Ray Dalio, Paul Tudor Jones, and Stanley Druckenmiller.

As these firms enter the industry, they will need to access data products, and Messari has done much of the heavy lifting for them.

What Makes Messari Different from Other Research Platforms?

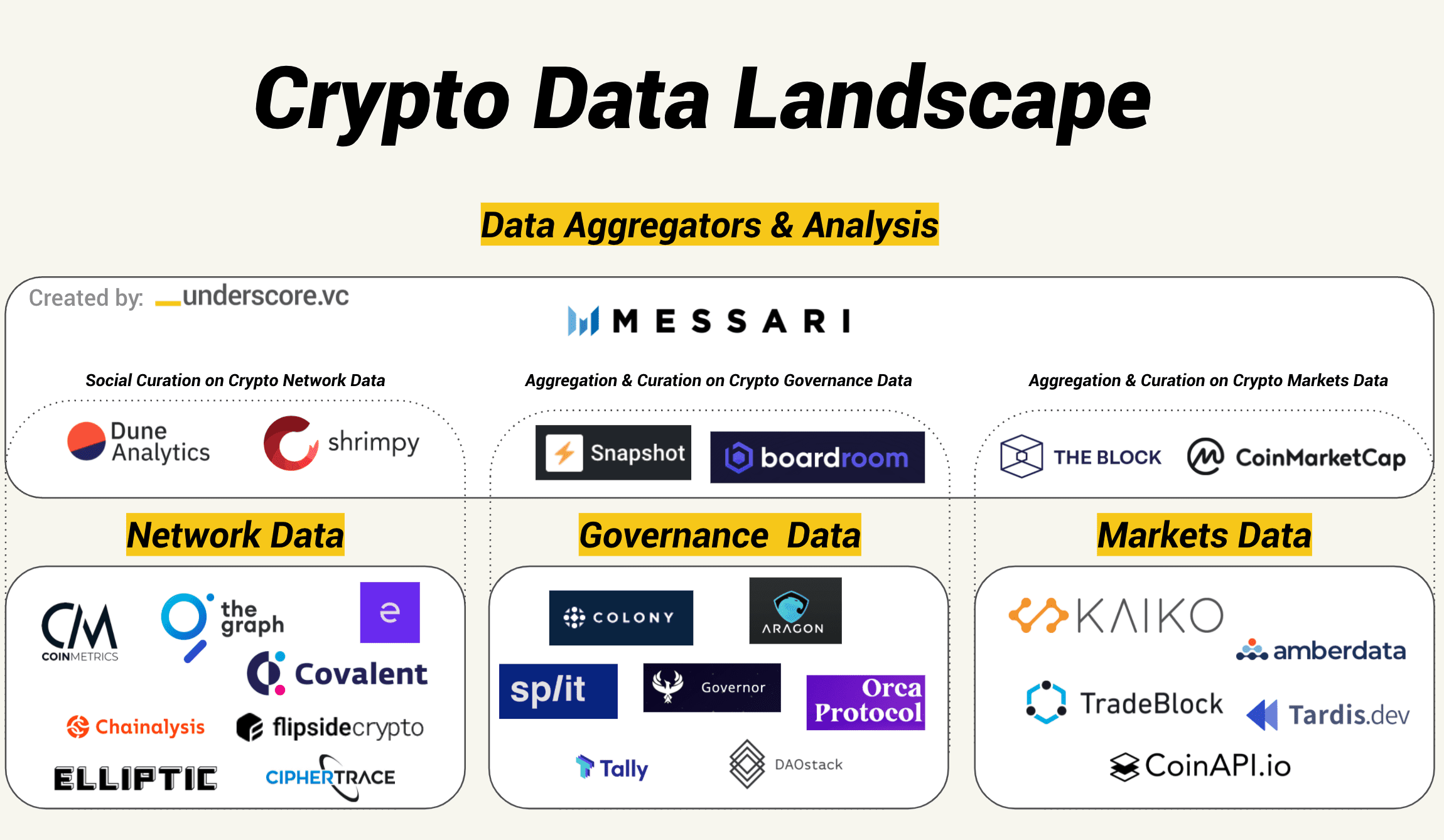

As we have previously detailed in our Crypto Data Landscape and our blog post detailing why we invested in Kaiko (which provides all market-specific price data to Messari), we believe crypto asset data is going to be a big business and has the potential to be more valuable than data for traditional capital markets. Crypto is going mainstream and the market needs crypto-specific analytics tools that understand this new asset class better than Wall Street incumbents that have been slow on the uptake until now.

Messari has differentiated itself from other research platforms by having a focus on transparency, product development velocity, and community involvement/engagement – critical ingredients in building an ecosystem around any information platform.

We see the category as having three main pillars, on-chain network data, governance data, and markets data:

Messari sits across all of these pillars to become a foundational “one stop shop” for investors, much like Bloomberg did in the early digitization of financial markets.

What Is Next For Messari?

Today, Messari is about helping investors and professionals discover, diligence, and participate in the emerging crypto-asset ecosystem. Unpacking those:

- Discover means to find and learn as an aggregator and news source.

- Diligence means digging deep into proprietary intelligence beyond commodity data (which comes from partners that want leverage in their G2M through an aggregator like Messari).

- Participate means active participation in discussion and governance, to centralize the communication to token holders through Messari. Like shareholder discussions, the world of crypto is even more dynamic, with actual votes happening on-chain, and open protocols changing based on these discussions and votes.

As the company charts the course ahead, the last bucket, participation, and on-chain governance are going to be massively important, and to that end, much of the product roadmap going forward is intended to expand on this dimension that will be critical for investment decision-makers going forward. To that end, we could not be more excited for what lies ahead and look forward to supporting Messari into the next stages of growth.