(Read Part 1: Erosion of Trust: How low must we go before we act?)

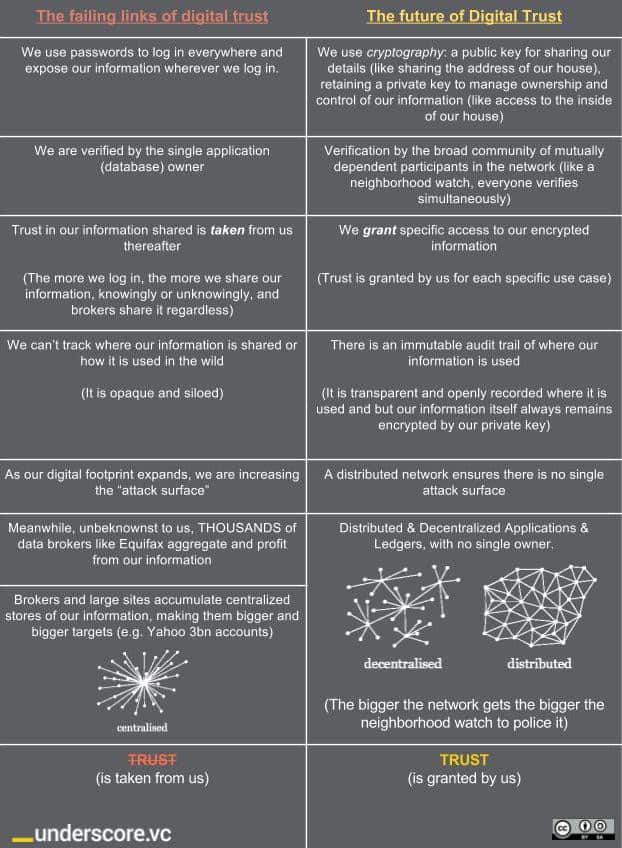

Sticking with our simplified personal example, we have to start at the beginning and create a digital identity that is encrypted, can be broadly verified by others when we use it, and yet when we share that information we keep the key to it, and the ownership of it to ourselves. We also need to ensure that the information never gets too centralized so that any one place becomes too big of a ”honeypot” / target (e.g. Equifax, Yahoo, your bank, etc.) nor allow too much of a dependency, control point or single point of potential failure.

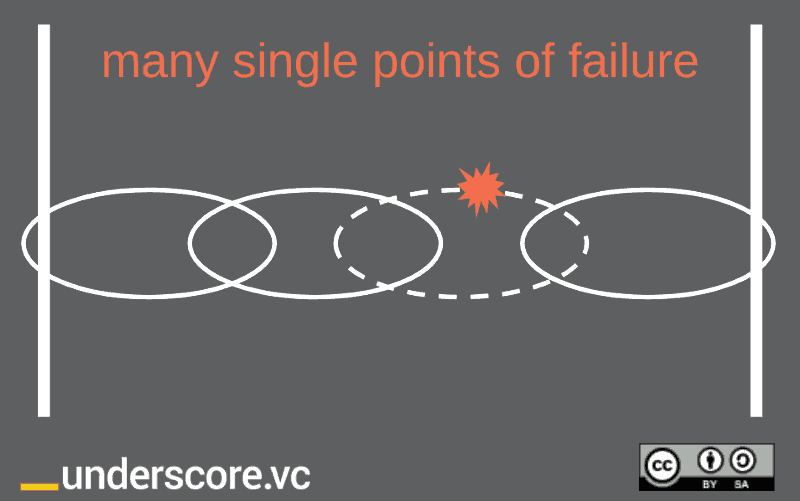

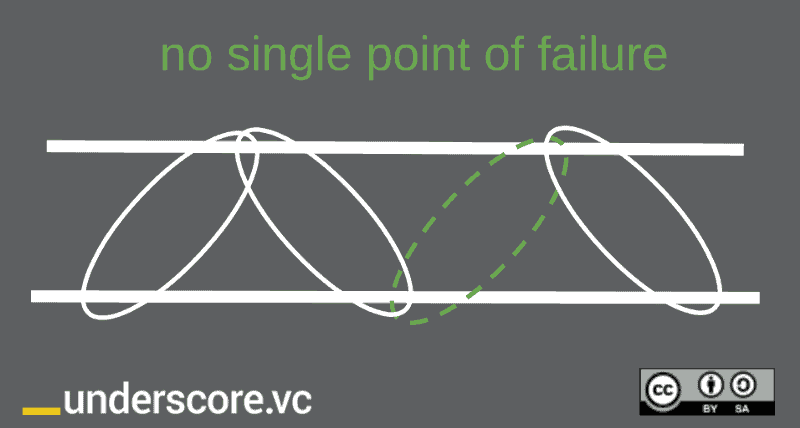

In short, we need to move from being dependent on the weakest link, which can be weakened as it grows —

— to a different kind of chain strengthened as it grows.

The blockchain offers some critical architectural components of the potential model for this. But of course not all, as it is early and this is nothing short of a re-thinking and re-architecture of our model of digital trust. But we’ve got to start somewhere and the blockchain provides a breakthrough re-imagination of how trust can be created.

Simplifying again, ultimately we will move from shared, assumed, opaque centralization of trust to owned, verified, transparent and immutably auditable distributed trust (click to tweet).

Today this may seem like a science fiction dream, but it’s no different than what might have seemed like a dream 20 years ago of connecting the world with a single addressing system — the Internet — and what we now take for granted as our World Wide Web. Improbable as the power of the internet was 20 years ago, so will this next statement seem today…

Blockchain will bring universal trust to transactions, just as the internet brought universal addressing to communications (click to tweet).

How? Well in this article you just learned a number of the key principles of blockchain. But it’s in its early days (like the internet in the mid 90’s) and there is certainly no magical solution in blockchain or anything else. So we can’t just start with “HOW?”. That’s why this article has started with WHY? Necessity is the mother of invention, and entrepreneurs have shown over and over again how we can and do solve the problems of our time. Let’s hope we don’t have to continue to endure more breaches of our trust before we consider this a rallying cry to develop a future where fallible as we are as humans, digital trust is as accessible to us all as any utility (click to tweet). If you want this future, share your thoughts and comments below.

Meanwhile at Underscore VC, we’ll be investing in transformative entrepreneurs to build a future with digital trust you can own, verify and track. Interested in learning more about what happens after the crypto bubble bursts? Read Part 3 — After the Bust: Building Out Blockchain Technology. To learn our criteria to qualify a blockchain project, read Part 4 — 3 Investment Criteria to Qualify a Blockchain Project.

###

Written with contributions by Bryan House, Ben Jones, Michael Skok and our Core Community.