When there’s a major tech innovation like the internet or blockchain, the question of when to invest and in what companies is always a challenge. For example, search is fundamental to the internet. But how could you have identified the right timing and the right entrepreneurs to invest in a Google instead of an Alta Vista?

Let’s step back in time and consider a non-technical example from the California Gold Rush, and introduce John Sutter and Levi Strauss. John owned the land where the first Californian gold was found. He must have made a fortune, right? Wrong! Meanwhile, Levi made far more than many miners by selling denim — the durable fabric which the workers wore as blue jeans. Over 150 years later, Levi Strauss is still making billions of dollars as an enduring business.

These two experiences illustrate the potential of critical choices for infrastructural investment, and beg the question: what will be the equivalent of Levi’s denim that is investable in the boom, bust, and buildout of the Blockchain era?

Historically, not all web infrastructure was investable. For example, every email you send utilizes SMTP (Simple Mail Transport Protocol), yet it was standardized and freely leveraged, and was not investable.

In Blockchain’s case, the infrastructure includes some fundamental innovations around new protocols, decentralization, and consensus. Blockchains may make deeper levels of technology investable for the first time. One part of this was well illustrated by Joel Monegro in Fat Protocols, who argued for blockchain that the market cap of underlying protocols such as IPFS will always remain higher than the applications built on top, unlike the previous generation such as SMTP.

But, fat or thin, there has always been a challenge in determining what to invest in and when. As investors, the way we think of it is simplified for illustration in the framework below. We hope sharing it will be helpful to you as entrepreneurs for qualifying your potential business.

Community and Network effects:

Blockchains and distributed applications typically require communities and networks to support the project, including miners in many cases

- Is the community self-served by this project’s utility and value proposition?

- Is there a clear connection between increased adoption and protocol utility?

- Does this result in greater value for users of the blockchain service and, eventually, a defensible market position?

- What needs to happen, other than a token sale, to kickstart the creation of network effects and stimulate its use?

- Is there a path to achieving network effects, and how does the value to users increase as the number of users increases?

- How is your team uniquely advantaged to build this blockchain project?

Wide foundational applicability:

The most valuable infrastructure will enable broad use cases, offering a foundational element and even in time a platform that will enable the development of many decentralized applications as a horizontal layer. But in the early days end to end solutions will be hard to build.

- Is the value proposition uniquely suited for blockchain-based applications?

- Is the application immediately valuable, standalone? If not, what is it dependent on?

- Is the business focused on a particular domain, or enabling platform like functionality for decentralized applications?

Disruptive business value:

One of the biggest challenges facing any new technology is the status quo, and this is no different for blockchain today. We must ask:

- Is this new technology substantively different from how things work today?

- Why would someone switch, and is the pain of switching really worth the risk to achieve the gain? [See gain/pain models here]

- Does it unlock a new way to achieve a business outcome or consumer benefit?

- In blockchain’s case, could you really just get away with a well-managed shared database versus a distributed ledger?

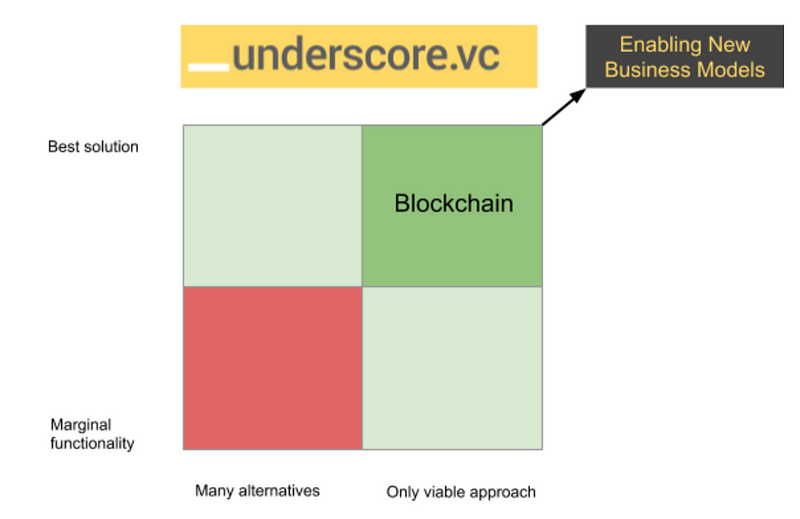

- Is a blockchain-based approach the BEST and/or ONLY way you can solve this problem?

(See below — one of Underscore.VC’s investment frameworks to help review this)

We are already invested in Blockchain and are working with transformative founders using these criteria to make further investments. These founders are innovating around new protocols, decentralization, and consensus, to build fundamentally new infrastructure for future applications and services.

Why infrastructure? Because in the long run just like Levis and blue jeans, infrastructure will endure best. Blockchain is exhibiting the same cycles as the web. Beyond this initial boom, there will be a bust. But the opportunity to invest in infrastructure that extends beyond the bust to a buildout phase will ultimately bring the digital trust to the web.

We’ve laid out our criteria. What are yours?

This is the end of a four-part series, read Part 1 — Erosion of Trust: How low must we go before we act?, Part 2 — Preemptively Creating a System of Digital Trust, and Part 3 — After the Bust: Building Out Blockchain Technology