One year ago, the world was learning to adapt to being digital-first. In the wake of the pandemic, markets across the world were quickly selling off. And within the crypto community lay murky aftertaste and a not-so-fond memory of “Black Thursday,” a day when the price of all crypto tanked in unison, pushing crypto infrastructure to its knees.

Institutions, small businesses, and individuals alike all lost wealth as measured by their assets. Another category of organizations, called DAOs, or decentralized autonomous organizations, had felt this pain too. What came from it? The story that is told in the year to follow sets the case that these mystical, and somewhat theoretical, organizations might just be the premiere setup for all institutions and businesses alike one day.

The name decentralized autonomous organization can be confusing. Let’s break it down, in reverse:

- Organization: everyone knows this part, and it can be easily referred to as a group of humans and optionally other organizations.

- Autonomous: in this context, meaning able to self-persevere without outside influence. Similar to an “autonomous” region in a country that is able to self-govern (i.e. Hong Kong).

- Decentralized: referring to the technology on which these autonomous organizations are built, and further referenced in this piece as smart contracts on the Ethereum blockchain. The opposite of this might be organizations built on legal papers ratified by a central authority, aka government.

In summary: a DAO is created by a group of crypto wallets controlled by individuals and other organizations that executes all its movements through code, making it possible to manage assets and votes safely without the need for underlying legal or traditional banking setups. Membership in a DAO can be extremely fluid compared to what traditional organizations can achieve, and DAOs have been used to manage assets, build protocols, vote on community matters, and create niche factions for interests like digital art collecting.

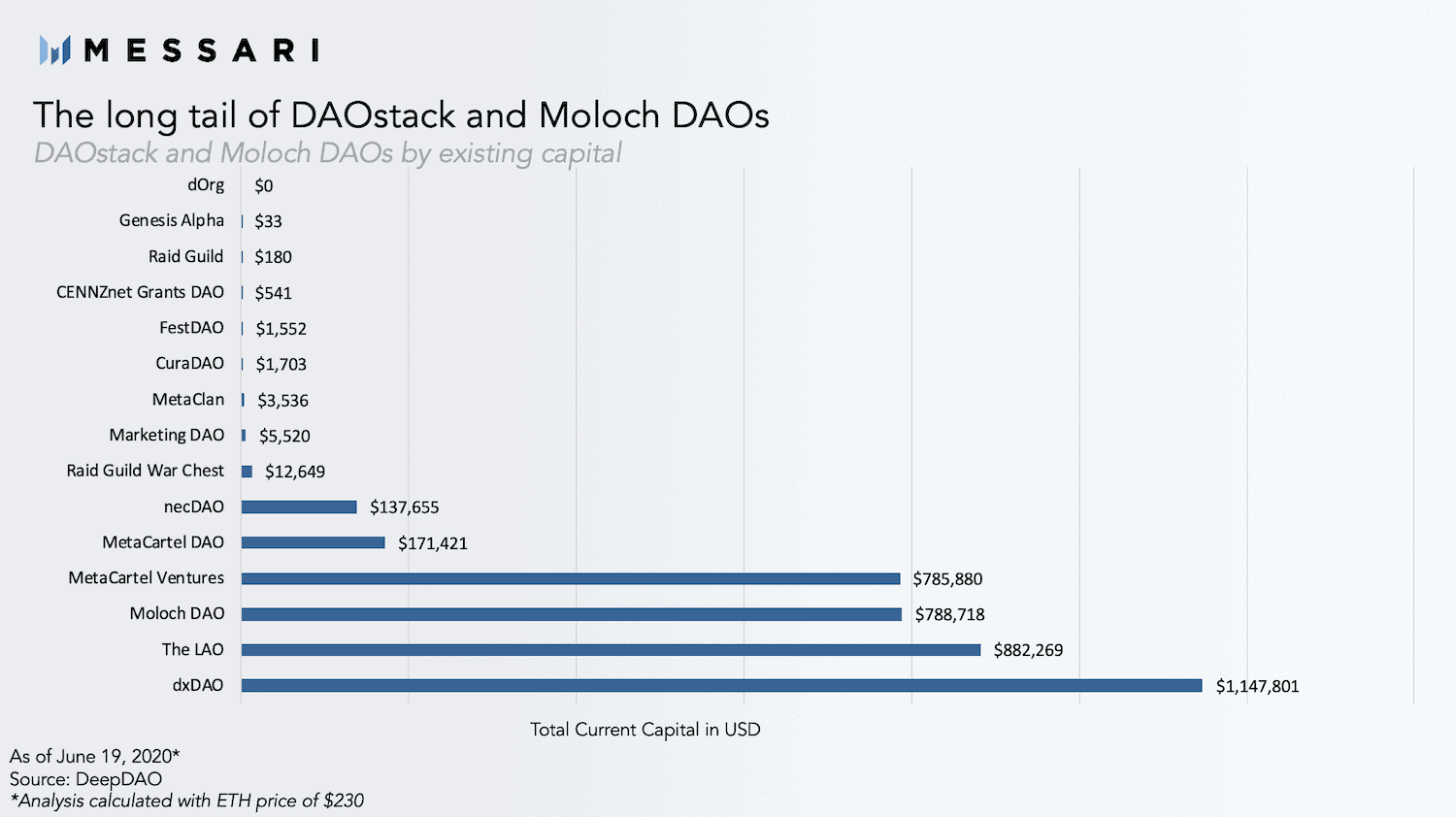

Let’s look back to 2020 one more time and paint a picture of trajectory. At a time when $ETH was trading at $230, DAOs barely made a dent in the financial world, with the long tail of them holding only a few thousand dollars worth of assets:

Snapshot of DAO assets. Source: Messari (Underscore VC Portfolio Company)

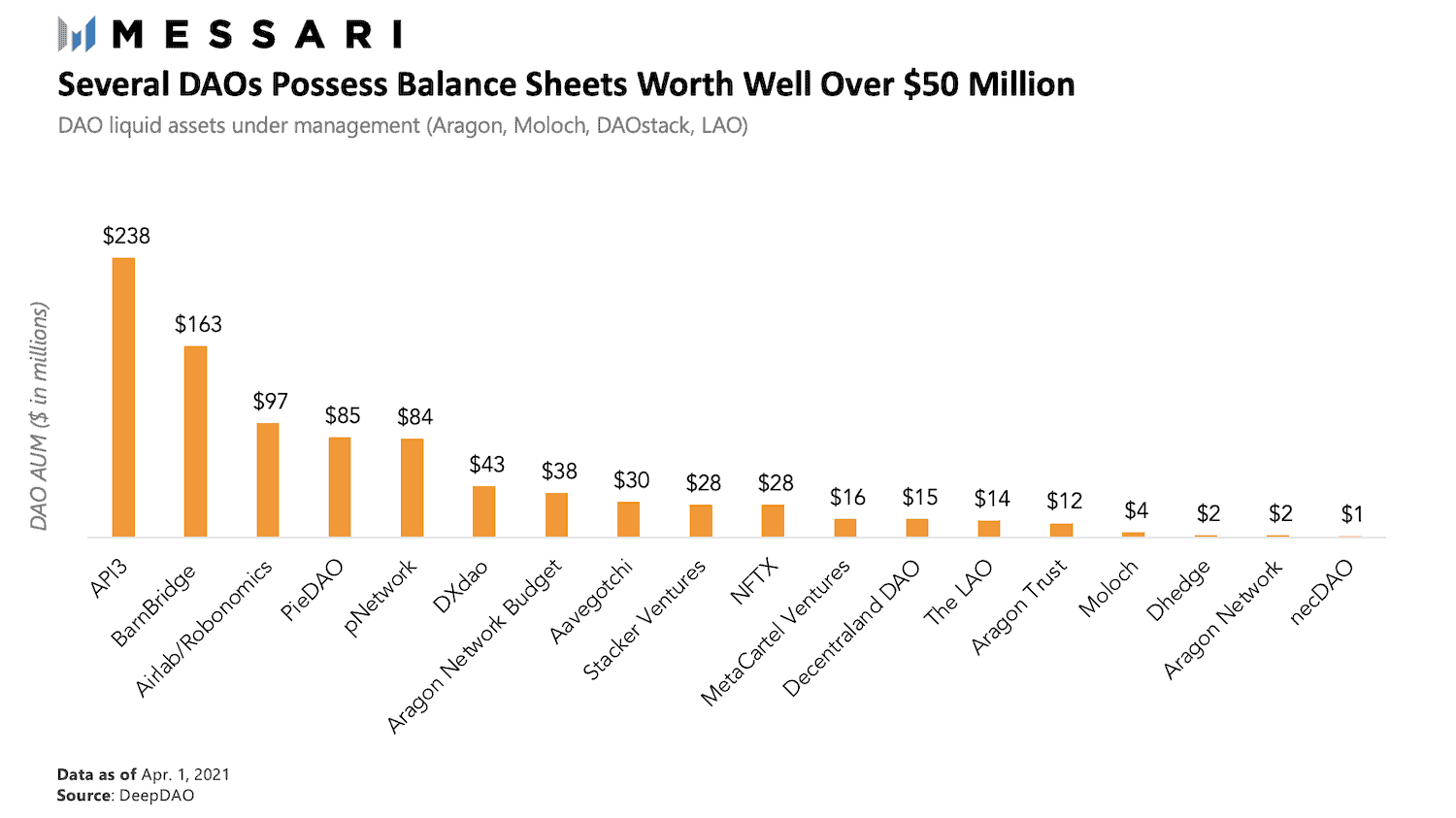

After a year-long crypto bull market, millions of new people introduced to crypto, and thousands of projects launched and generating fees — let’s just say things are different today:

Figure 2. 2021 Snapshot of DAO assets. Source: Messari (Underscore VC Portfolio Company)

We’re now measuring DAO holdings in the millions. It doesn’t stop there even — widely adopted crypto protocols that have been built over the past year control huge treasuries of their native token, sometimes totaling in the billions in terms of the worth of those assets. An example of this is Uniswap, a massively successful protocol that allows for decentralized and permissionless trading of assets on Ethereum. Their treasury? About $7,200,000,000; or over seven billion dollars worth of mostly UNI tokens. (we can check this total along with treasury movements at any time we want; the data is fully transparent and able to be queried by anyone!)

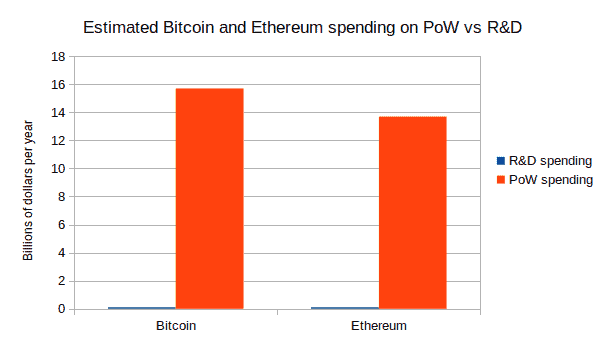

The effect of this massive wealth inflation by this category of organizations is wondrous. As Ethereum- founder Vitalik Buterin points out in this great blog post, funding of engineering and development for public blockchains is minuscule compared to the value they create.

Figure 3. Relative funding of public blockchain development. Source: Vitalik Buterin

From millions to billions in assets, a zeitgeist-market fit, and a future irreversibly dominated by the internet, DAOs have gone from being a clubhouse for crypto-nerds, to the equivalent of a boardroom full of suits when it comes to dealing with serious matters of business. With this level of power comes the ability for the early crypto community to now build out serious grant ecosystems for public goods, provide benefits for users of their ecosystem, decentralized philanthropy, and most importantly — further decentralize.

The Future Boardroom of Internet Organizations

A simple thesis: the most important DAOs will govern many billions of dollars and control, as just one example, the upgrade path for the future financial infrastructure of the world. The tokens by which grant access to DAO voting will play an increasingly important position for investors to take best interest changes into their own hands, while also earning revenue from the success playing out through protocol fees. These assets are a superset of what equity in a traditional public company is, and thus will flourish in the DeFi world in which they were natively built. Furthermore, lending and borrowing of governance tokens will make voting power fluid and reactive to the value of the vote, incentivizing great protocols to make great decisions. Welcome to the internet boardroom.

Compound Finance DAO Example #1

Let’s start with a concrete example: Compound Finance.

Compound is an algorithmic money market built on Ethereum. This basically allows you to borrow money by putting up other money as collateral. Have some bitcoin? Put it in Compound and borrow dollars against it. Earn interest on the bitcoin, pay interest on the dollars. Or just put in dollars and earn interest, which is currently sitting at a cool 6% APR.

The magic and excitement enabled here is that it is unstoppable, permissionless, and algorithmically controlled. An application built on ethereum cannot be censored, anyone with access to the internet can use it, and all the calculations (i.e. APRs) are done by well-audited code.

Where do DAOs come in? Well, the Compound protocol needs community consensus on which new markets to add, what parameters to change, how to issue COMP governance tokens (as a reward to protocol participants so they can participate in the DAO as well), and what to do with their three billion dollar treasury! Amazingly, by owning COMP tokens, your ownership weight is your voting weight! Own 1% of the COMP supply, get 1% of the vote for proposals. This is similar to having voting shares in a company, except you’ll enjoy much more freedom by owning transferable, permissionless COMP tokens.

Because the proposal and implementation process is algorithmic and on-chain at the end of the day, we can use a tool called Tally (though there’s plenty of others that will display the same info) to view what’s going on with Compound: withtally.com/governance/compound.

Let’s look at a simple proposal for Compound, proposal 37: “Return Accidentally Sent Funds.”

Should Compound implement functionality in their smart contracts on Ethereum to return whatever tokens that some user accidentally sent directly to the protocol on accident? The way it sat, the protocol had no way of returning those funds — code is law! If passed, the updated code will be deployed as new contracts on the Ethereum blockchain (automatically if the signature threshold is passed), and now a future user can claim funds that they accidentally sent to the wrong Compound pool address. How helpful! (FYI do not send funds directly to smart contracts unless stated otherwise, it’s obviously a big enough issue to warrant governance vote!)

According to the Tally page, Robert Leshner, founder of Compound, and owner of over 1% of COMP tokens, votes yes by signing with his wallet that holds the COMP tokens. Let’s repeat this, by holding COMP tokens, there is no second step needed to vote from any address in the world. No KYC, no jurisdiction, no overhead. Just pure community consensus on what is best for the DAO.

The new properties of organizations built as a DAO

A lot of DAOs implement a function in their smart contracts called ragequit. This function serves simply to let any DAO member call it, and immediately remove themselves from the DAO, receiving their pro rata assortment of assets. This is remarkable in a number of ways! Let’s think of a real-world example where a partnership agreement specifies in writing how a member could leave and take their share of money out of the company. Traditionally, if all goes well, paperwork is signed, and in a few days, all is well and on its way. Some of the assets might be hard to liquidate or split up, but it’ll get sorted. In another scenario where there is a dispute on the terms, lawyers involved and all, leaving a partnership might take months and be very expensive! The ragequit function is agnostic to all this. The second it’s called, assets are transferred according to the rules, no papers are signed, no one even has to check! This can all happen within a few seconds. Most importantly, it’s agnostic to how anyone feels. An unruly member can’t get in the way.

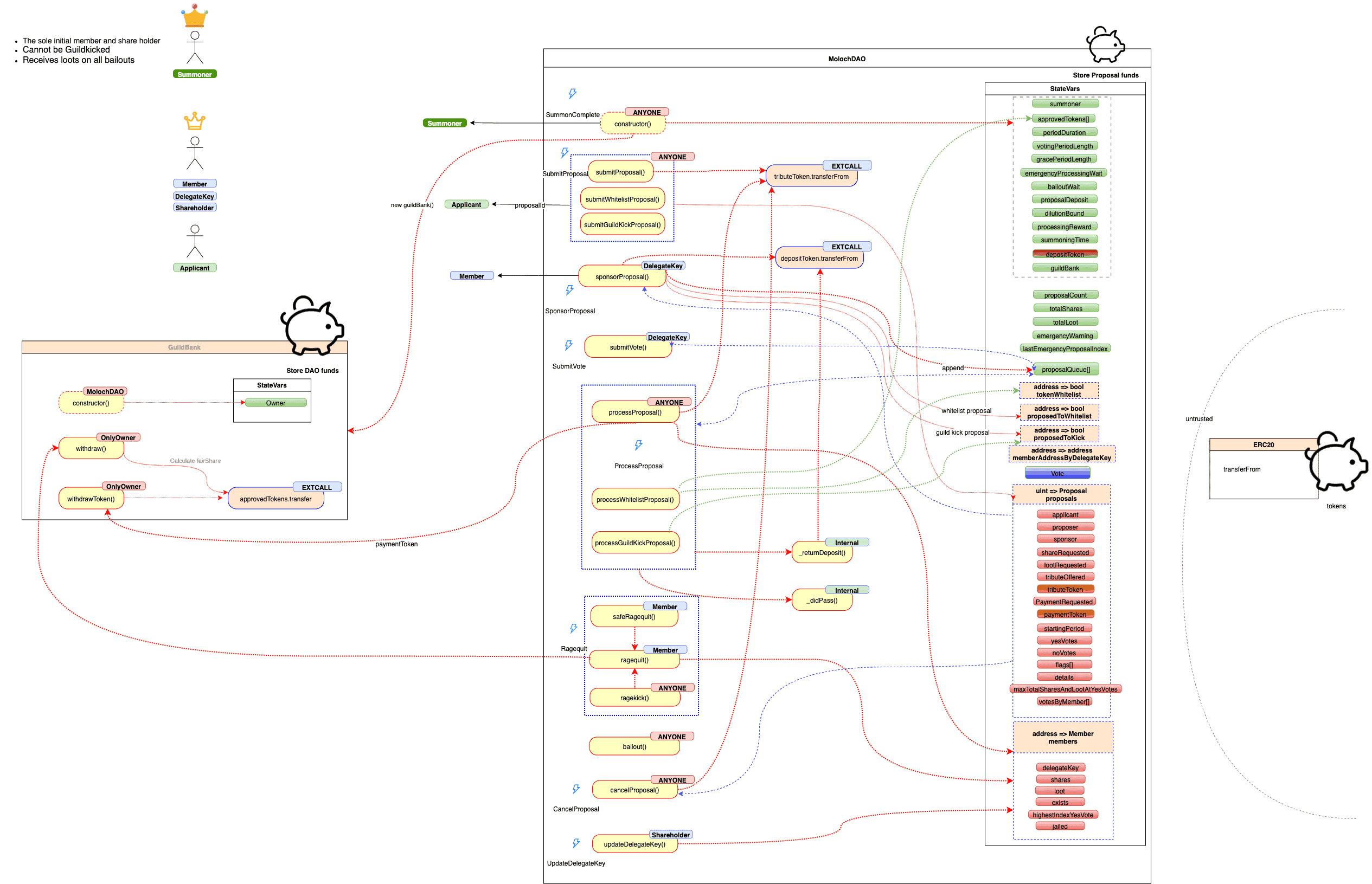

Figure 3. Generic DAO flowchart with ragequit(). Source: Consensys

The disparity between traditional organizations and DAOs in these edge cases is really important, and what in essence can lead to their future takeover. By natural selection, the organizations that are the most fit and resilient will last. What’s more resilient and permanent than a DAO? Nothing! The fluidity goes above and beyond what any paperwork can ever implement, and can scale larger than any corporation that exists right now. In fact, there’s no reason why an entire country cannot be a DAO.

Let’s go a step further in terms of mechanics. Going back to the Compound example, since COMP tokens are required to vote, and since they’re freely traded on the market, it’s really easy to buy votes! While this might give inherent value to these tokens (if they were super cheap, a bad actor could buy them all up and ruin the system), this also sets up secondary money markets for power. Instead of depositing collateral to get some cash, you can in theory deposit collateral, and take out voting power! This puts a whole new spin on “money is power”. A large bitcoin whale could deposit wrapped bitcoins into compound, borrow a bunch of COMP, vote on their wishes, return the COMP, and leave with their BTC untouched.

This might sound scary, and even borderline plutocratic. The point that I think should be driven home is that we’re about to see a whole new level of efficiency where the lines between capital and governance are blurred (hat tip to Joel Monegro on governance).

Other Examples of DAOs, in and out of DeFi

DAOs can be charged with doing anything really. There are DAOs for bringing bitcoin to ethereum (BadgerDAO), collecting art (FlamingoDAO — check out their entire collection here), and even a DAO run by other DAOs responsible for building DAO tools.

This last one is called UberHaus, and they’re responsible for governing the DAOhaus platform so that new DAOs can launch with all the tools they need. More on this in the picks and shovels section.

An internet boardroom does not need to apply solely to profit-generating organizations. The rise of NFTs, which Underscore VC wrote about back in 2019 has shown artist and cultural interest in crypto beyond the cypherpunks. This has been validated as DAOs have spun up to manage digital art collections. For example, a last minute DAO, called PleasrDAO (collection here), was spun up to buy a commemorative NFT for the launch of a new Uniswap version with the proceeds going to charity. The group funded the DAO extremely quickly and bought the NFT for $2.5M! Here it is:

Figure 4. A $2.5M mp4 file owned by PleasrDAO. Source

[arve url=”https://storage.opensea.io/files/cfd460bf606521efeae65f9925d593fe.mp4″ title=”Figure 4. A $2.5M mp4 file owned by a PleasrDAO. Source” /]

What about traditional businesses, say your run-of-the-mill Fortune 500 company? Why would all businesses be controlled by a DAO on day? Nexus Mutual is an insurance mutual that provides cover to its members that are exposed to various risks in crypto. The DAO model is wrapped in a legal entity for compliance purposes, but otherwise is able to operate ultra-efficiently as a DAO on ethereum. This model allows for them to operate an insurance mutual solely over the internet, with a rigid and trustworthy structure that is incentivized to pay out claims.

Picks and Shovels for DAOs

DAOs are code, and code is hard. As things progress, not every group of people will be able to program their own DAO, just like not everyone can write up the legal papers for an LLC or code their own website. The tools here are incredibly important.

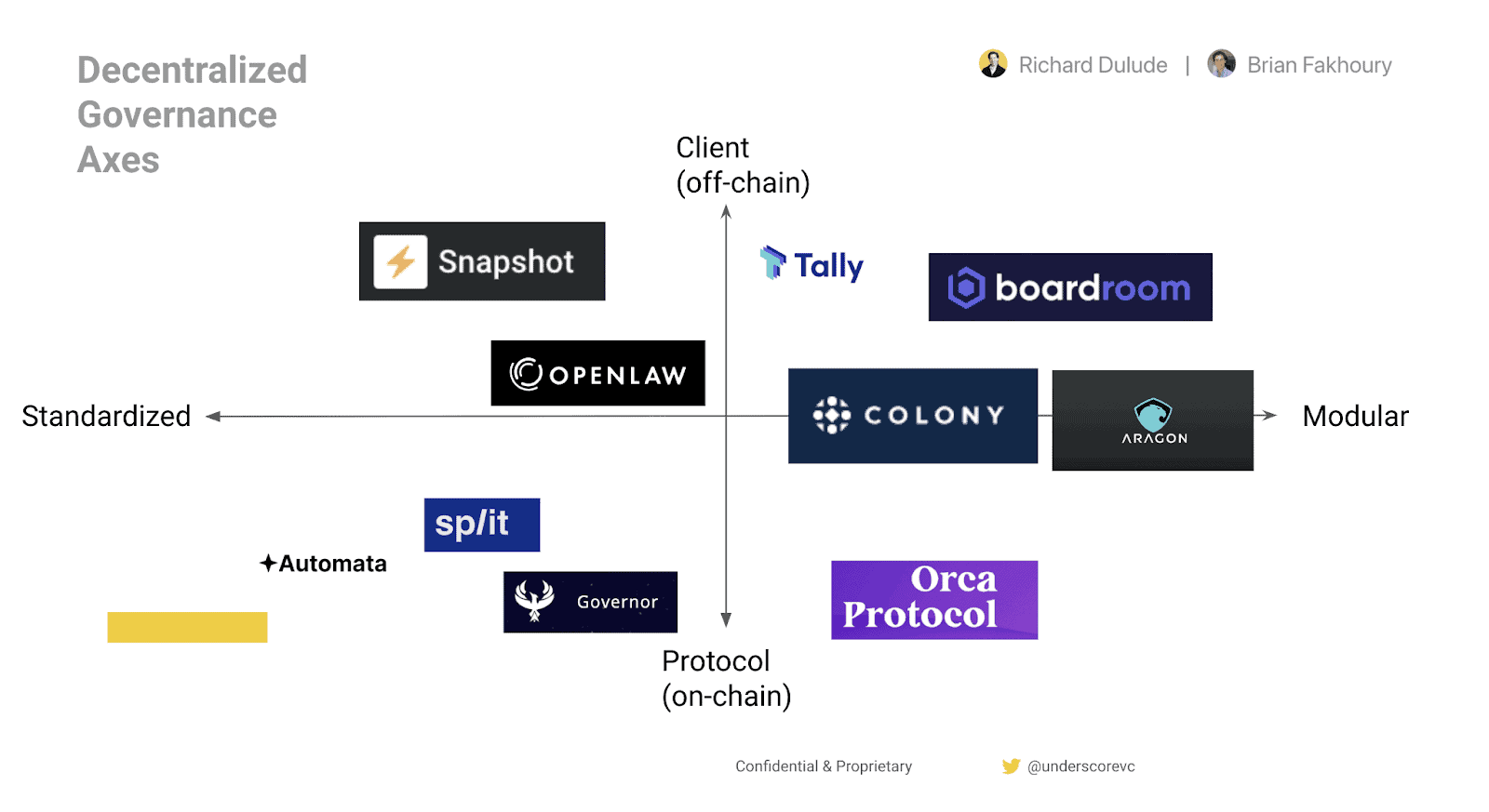

Figure 5. A rough landscape of the picks and shovels for DAOs. Source: Underscore VC

I mentioned DAOhaus as an all-in-one solution, but as we see above, there’s plenty of individual tools that can be used. For example, Snapshot lets you collect signatures for a proposal in an off-chain manner. The use case is that for wallets that hold your governance token, a signature by that wallet is more than enough proof of vote, and saves the costs of creating transactions on the blockchain. Imagine holding $100 worth of COMP and having to pay $20 to vote on a single proposal. Aragon is more similar to DAOhaus, offering a modular assembly approach to pick and choose for your DAO.

A Call to Action: Are You Working On DAO Tools? Do you know of interesting projects in the space? Let’s talk!

At Underscore, we believe DeFi will rewrite the financial operating system of the world, and that governance of crypto at large is a trillion-dollar opportunity. Innovations that help control treasuries and better organize economic players will make the crypto metaverse a well-oiled business machine capable of capital coordination at scale that will make the future brighter.

Fun fact:

As I was writing this article, the Compound treasury went from $2B to $3B. The Uniswap treasury increased by over a billion dollars as well. I had to revise these numbers 3 times!

Other reading and sources

https://medium.com/odyssy/moloch-primer-for-humans-9e6a4f258f78

https://daohaus.substack.com/p/rage-quit-exit-rights-and-real-skin

https://consensys.net/diligence/audits/2020/01/the-lao/

https://ournetwork.substack.com/p/our-network-deep-dive-2

https://newsletter.banklesshq.com/p/how-daos-should-approach-treasury

https://medium.com/daohaus-club/uberhaus-is-alive-%EF%B8%8F-3af528dc3494

https://www.placeholder.vc/blog/2019/2/19/cryptonetwork-governance-as-capital