Every business has to buy commercial insurance. It’s so common, you would think it would be easy to do online – it’s not. Today the process is largely still manual and offline for everyone involved – the businesses, the brokers who sell insurance, and carriers providing the policies.

This process is especially painful for the 30.5M small businesses in the US. I’ve personally witnessed my sister, who is a commercial insurance broker, spend hours sending excel sheets and PDFs back and forth via email to multiple carriers to get quotes for a single customer, then manually entering in quote data as it comes in.

The process of buying commercial insurance needs to move online. But many of the industry players today simply don’t have the skills or expertise to do this. Software developers working on this problem at traditional brokerages, insurtechs, and carriers all have to invest months of time manually building out and managing their own integrations across dozens of carriers and multiple business lines. Instead, they want to be focused on delivering their core value and great customer experience (innovation, not integrations!). The commercial insurance industry lacks a unified digital infrastructure to enable seamless and scalable data exchange.

Herald builds digital infrastructure that connects software developers to commercial insurance carriers through a single API. By providing the best infrastructure for developers, Herald is empowering both the carrier side and broker side of the market to move commercial insurance online. What used to take months of development time and days (even weeks) of email back and forth can now be delivered within hours.

Today we are excited to share why Underscore VC backed the Herald team. As earliest investors, we’ve doubled down, investing in the team’s $8M Seed round alongside Lightspeed, Afore Capital, and a great group of angels from the insurance and fintech community, including Garrett Koehn (President, CRC Group), Rotem Iram (Founder and CEO, At-Bay), and Charley Ma (General Manager, Alloy), among others.

As always, our investment is driven by a uniquely qualified team tackling a big unsolved problem in a huge and growing market.

Uniquely Qualified Team

Our decision to invest in Herald pre-dates the product. Why? “Founder Market Fit.”

Firstly, the Herald cofounders Matt Antoszyk and Duncan Crystal have first-hand experience with the pain of managing carrier integrations in commercial insurance. While at At-Bay (a digital cyber insurance provider, which is now an insurtech unicorn), Matt and Duncan helped launch their first cyber insurance API.

While working with digital brokerages and broker technology companies, Matt and Duncan discovered the customer pain of integrating multiple carriers for every supported line of business. Customers complained about normalizing divergent data models, analyzing poorly-written or non-existent API documentation, and maintaining APIs over time. After hearing versions of these challenges from every part of the ecosystem, Matt and Duncan realized they were in a unique position to help.

Secondly, Matt and Duncan have deep industry connections and earned trust, as evidenced by their early backers, including their former employer. At-Bay CEO Rotem Iram identified them as the “top 1% I’ve ever worked with,” leading him to back the team as an early angel. Matt and Duncan quickly brought on Jacob Barnett as CTO, who similarly lived in this space as he built the core rating technology and quoting experience at Haven Life (an insurtech owned by MassMutual).

As investors in multiple insurtech companies, we recognize that insurance is an industry that requires deep experience and a personal network to establish credibility and navigate the complexities of the fragmented and tight-knit ecosystem. It’s not often we come across founders in the insurance space with the combination of industry expertise, deep product prowess, and such thoughtfulness and complementarity as founders.

The Market Opportunity for Digital Infrastructure in Insurance

Speed, agility, and personalization are increasingly in demand in financial services. Specifically, in commercial insurance, carriers need to increase their speed of distribution, and brokers need to digitize their workflows for faster, more customizable delivery of policies. Both of these sides need a modern API infrastructure to achieve these goals.

Today there is a big opportunity to move insurance sales online, but this opportunity is inhibited by challenges developers face in integrating with carriers’ APIs. The challenges exist because:

- The number of different carriers in this fragmented market (with the largest provider of commercial insurance covering just 5.5% of the market)

- Stability, functionality, and accuracy are unreliable in existing infrastructure

- Carriers are often using legacy technology

- There is regulatory complexity to manage

In other areas of financial services, we’ve seen the important role of API-first digital infrastructure. Players like Plaid and Stripe unlock major shifts in personal and commercial financial transactions, all while producing data that has its own value.

While insurance doesn’t have the same frequency and volume of transactions as personal finance, for example, the size and significance of each transaction in insurance are larger. Each data exchange is part of a meaningful transaction. There is a big opportunity to power the entire insurance lifecycle from quote and close to bill and renew and everything in between across all commercial insurance products. The revenue stream captured as a result of such data exchange in commercial insurance is expected to reach $300B by 2026.

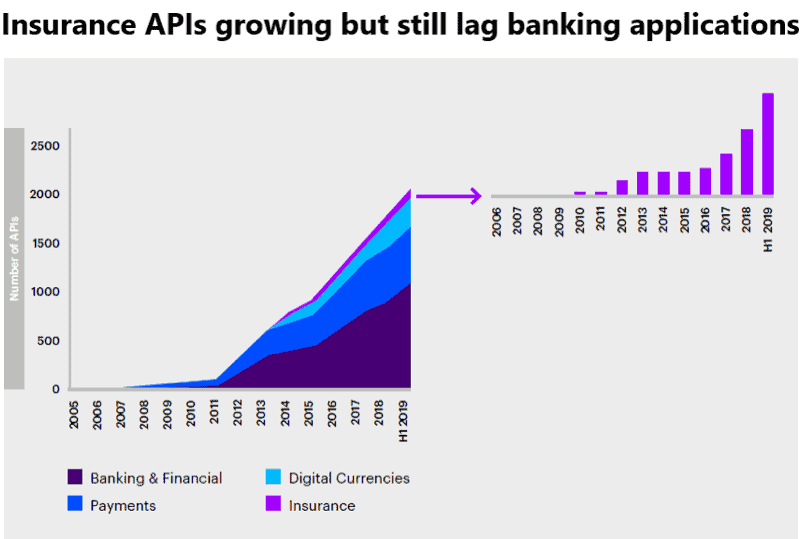

Yet the number of APIs in insurance lags behind, for many of the reasons described above.

Source: https://insuranceblog.accenture.com/open-insurance-success-hinges-on-the-right-apis

But this is starting to change. Today there is increased pressure on the insurance industry driving digital adoption, motivated by trends like the rise of neo-insurers (like Lemonade), digitally native MGAs (Managing General Agents) setting new standards on customer experience, and new distribution opportunities created through embedded insurance.

These opportunities all require an API infrastructure to realize their full potential. We are in the early days, and Herald API is positioned to be a market leader providing these digital rails.

Action and Traction

From day one, the lean Herald team has shown a propensity for action, which has led to impressive early traction. They are rapidly adding new lines of insurance, and today, software developers can use Herald’s API to get quotes across multiple lines of business (Workers Compensation, Business Owners Policy, General Liability) across multiple carriers. The Herald team has partnered with regional and national carriers and is rapidly expanding its integrations to extend its reach.

Brokers and insurtechs powering distribution channels are natural places to start. We believe there is a big near-term opportunity to accelerate digital adoption for traditional actors like brokers and incumbent carriers versus trying to disintermediate them. Meanwhile, this is setting the foundation (literally the infrastructure) for new distribution channel opportunities, like embedded insurance, one of the core components of our fintech/insurtech theses.

What’s Next for Herald?

With this exciting opportunity to become the infrastructure for commercial insurance, the team is expanding its product, engineering, and go-to-market teams, scaling support for additional lines of business, and accelerating integrations with its carrier partners. Check out their open roles here.

If you are a broker, carrier, or insurtech servicing the distribution of commercial insurance and looking to expedite your ability to sell commercial insurance online, learn more at heraldapi.com and follow on Twitter!