This post is a case study on how we applied Michael Skok’s 4A’s framework for Customer Success at Salsify. We’ll first do a quick background about Salsify and a refresher on the 4A’s, and then dive into details.

Customer Success is a lever that — when deployed effectively — can yield outsized benefits both for our customers and for our business.

But deciding on the best strategies and tactics to make that lever effective is not always obvious. As we’ve grown, we’ve continually faced trade-offs in how we direct our Customer Success efforts. These trade-offs are not unique to Salsify — all growing startups will end up facing them and deciding (either explicitly or implicitly!) how to address them. Examples include:

Should we pursue a high-touch or low-touch model for onboarding new customers?

Should a Customer Success team be aligned with product usage or revenue goals?

Should we build Customer Success as a services-oriented profit center or as an investment in current and future customers?

Should Support be part of a Customer Success team’s responsibilities? What about training? What about account management?

How should you account for Customer Success, services, and support in your business’s gross margin calculations? That is: Should you be concerned that overinvesting hurts key growth metrics from an investor’s perspective?

The decisions made here have a large impact on the successful pursuit of a company’s overall strategies around customer retention, expansion, and new customer acquisition.

About Salsify

Our Salsify team works with brands and retailers to build a product experience management platform that gives consumers exactly what they need to make educated buying decisions. We’re a high-growth startup working with customers ranging from mid-size brands like Hamilton Beach to large multinationals like Mars and Bosch. Our growth means that we’re rapidly onboarding new customers. Ensuring our customers’ success with Salsify is critical to our growth strategies.

We invested in building a Salsify Customer Success team early in our company’s history with the belief that investing in our customer’s success is key to the long-term prospects of a SaaS software startup. In the years since, we’ve learned a great deal about what Customer Success can mean for a B2B startup selling to midsize and enterprise customers:

The Power of One or Many Challenge & the 4As for Customer Success

In “The Power of One or Many”, Michael J Skok puts forth one of the key trade-offs that a Customer Success team faces. In brief, this challenge amounts to answering a series of questions:

Question: Should we focus on deep success within specific customer accounts, or should we focus on broad adoption of our product by large numbers of customers?

Answer: Yes! It’s critical to grow both within individual accounts and also to build a strong customer base across your market. That leads us to our next question…

Question: When should we focus on going broad or going deep?

Answer: Today! There’s no inherent reason to not do both, except for those pesky trade-offs. So the real question becomes…

Question: Should we prioritize going broad or going deep?

Now that’s a good question…

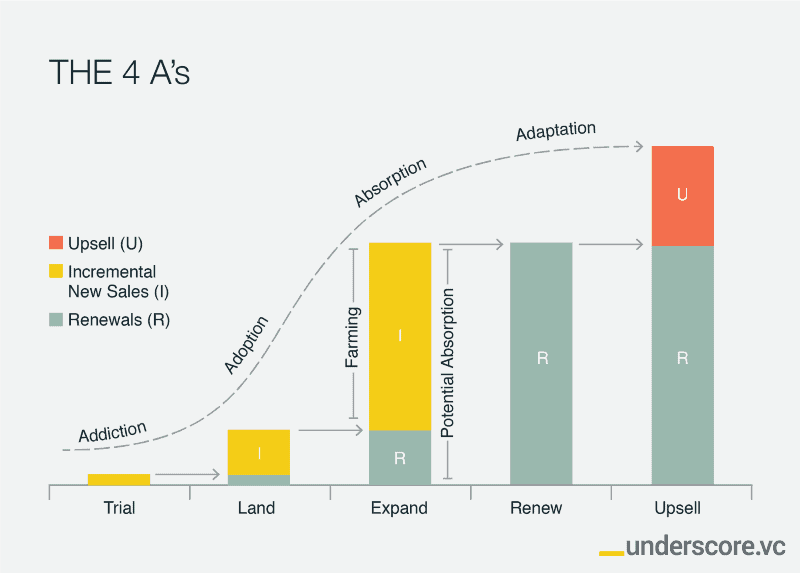

The Power of One or Many? provides a framework — the 4As — for addressing this question. The 4As present a series of stages that your customers go through as they interact with your product. This lets you better understand the status of a particular account and structure your team and your engagement with customers to help them along their journey through the 4As. The 4As are:

Addiction… during which your customers get initially hooked on your product and see the potential of investing additional time and resources to learn more

Adoption… during which a specific team or department begins using your product for a specific purpose

Absorption… during which your product is absorbed more broadly throughout a company

Adaptation… during which your customer identifies new business goals that can be accomplished via additional products, including products that may not yet be built

At Salsify, one of the core responsibilities of our Customer Success team is to enable our customers to move throughout the 4A stages. Our Customer Success team is uniquely positioned to understand the interconnected goals, requirements, and motivations of the brands and retailers we work with in order to drive attention to potential areas of addiction, adoption, absorption, and adaptation.

Thinking about our customer journey in terms of the 4As gives us a clear way to evaluate potential customer success strategies. However the nature of our business (high-growth, network-oriented) and our customers (mid-to-large companies) forces us to approach the 4As not just on an account-by-account basis, but also more broadly and more narrowly. The complexity of shepherding customers throughout the 4As requires us to be diligent about constantly measuring and iterating on the results of the customer success strategies that we pursue.

In the rest of this article we’ll discuss:

- How does a personal view of the 4As contribute to whole-account success?

- How do the same principles apply to our whole customer base to help fuel new customer acquisition and cross-customer success?

- How do we measure our progress?

- How do you get started?

The 4As for a B2B Startup

If you’re selling a product to consumers or SMBs, you can plot a customer’s path through addiction, adoption, absorption, and adaptation by engaging with a single person. For a B2B business selling to large enterprise accounts, the reality is quite different. At Salsify, we use the word ‘customer’ pretty freely, but we really mean at least three different things by it:

- An account — a company that has entered into a software subscription with Salsify.

- A team — the specific part of an account that we’re most engaged with.

- An individual — an individual person that we work with as part of Salsify sales cycles, onboardings, day-to-day usage, etc.

While accounts are different from teams which are different from individuals, they’re clearly interlinked. The eCommerce manager that oversees Salsify on a day-to-day basis at Bosch is part of a broader Bosch Power Tools eCommerce team, which in turn is part of our Bosch Power Tools account, which in turn is part of the Robert Bosch GmbH multinational corporation.

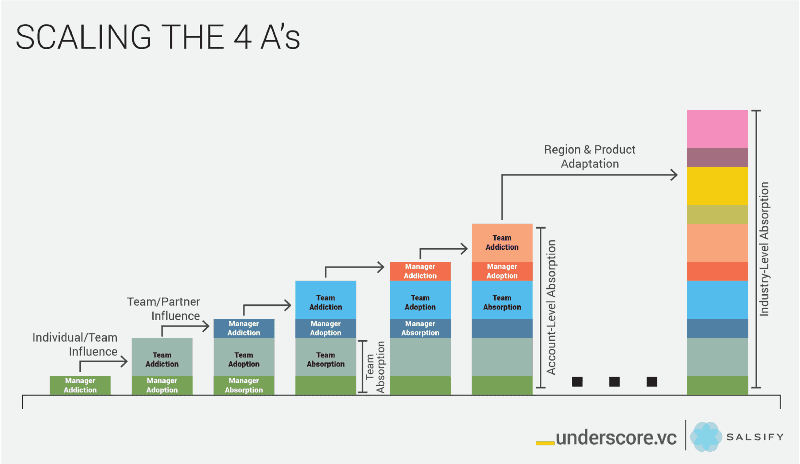

How does this affect our view of the 4As for a customer like Bosch? There are two key observations here:

First, the 4A framework is not an abstract classification of a faceless corporate entity. Instead each team — and each individual — goes through their own version of the 4As. Every person that touches Salsify at some point will journey through a highly personal rendition of the 4As. This journey will be very different for the individual who buys Salsify, for the person tasked with setting Salsify up and rolling it out to colleagues, for the IT manager enlisted to help connect Salsify to an existing ERP system, or for a sales rep who starts using Salsify months after it was initially set up.

The 4As scale within each specific account, and we must have multiple strategies for a single account that scale with them.

The second observation is how individuals’ 4A experiences layer together to contribute to an overall 4A curve for a team, which in turn layers with other teams to contribute to the addiction, adoption, absorption, and adaptation of an account as a whole. When a few brand managers adopt Salsify for managing their product descriptions, features, and benefits, the brand team as a whole starts to get addicted to using Salsify for collaborating over their brand’s product content. When Salsify is absorbed throughout the Walmart sales team, the Amazon sales team, and half a dozen brand teams in a large CPG manufacturer, the account as a whole has solidly reached the adoption stage of the 4As and an account manager can productively begin conversations of how to expand use of Salsify to new regions (account-level absorption driven by team absorption).

Who are the various personas that experience the 4As and contribute to the overall team- and account-wide success? In Startup Secrets, Michael Skok refers to them as the Decision Making Unit (DMU), consisting of visionaries, technocrats, operators, influencers, economic buyers, and decision makers. I’d highlight this. Their success = our success. Our customers often say this too At Salsify, we enlist members of the DMU for new customers as part of a “strike team” dedicated to the successful implementation of Salsify. The strike team might include an eCommerce director, peers on brand teams and product marketing, the eCommerce VP who owns the budget, sales reps, copywriters, and marketing managers who use Salsify every day, the IT director who owns integrations between Salsify and the internal technology ecosystem, and more.

Each of these people becomes addicted to Salsify at a different time and for a different reason; each adopts Salsify to accomplish their own goals; each has their own pace of absorbing Salsify for new use cases and adapting by expanding their use of Salsify in radical new ways.

For a Customer Success team looking to drive the overall success of an account, this layered view of the 4As helps inform how — and when — to engage with different people and different teams. At the individual level, mapping the steps that drive each persona from addiction to adoption and beyond shapes onboarding, training, and support engagement. Understanding how key thresholds of individual and team adoption act as triggers to get new individuals and teams to the addiction stage guides the timing and substance of account managers’ conversations.

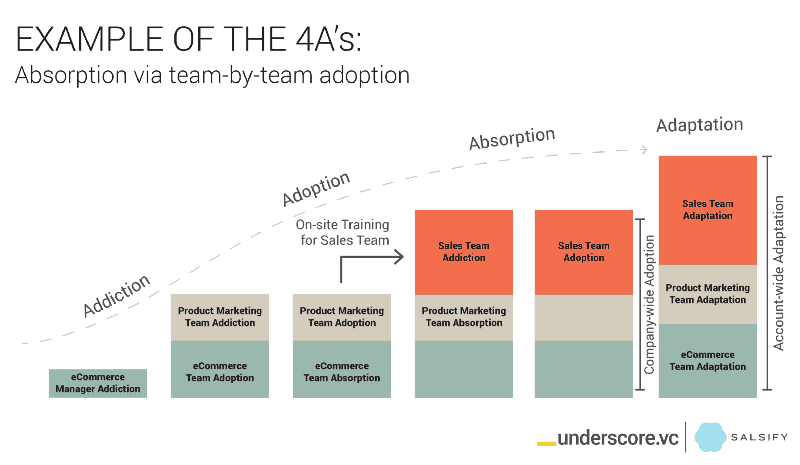

Example: Absorption via team-by-team adoption at a Large Consumer Appliances Manufacturer

An eCommerce director at a large consumer appliances manufacturer discovered Salsify while struggling to grow product assortments at Amazon.com, Walmart.com, and other key online retailers. He became addicted to the speed with which Salsify could deliver product content to online retailers, and he signed up with Salsify to tackle this specific problem.

During their onboarding period, our Customer Success team worked with a strike team at varied points of the 4A cycle: The eCommerce director and the managers on his team were rapidly adopting Salsify, but peers in product marketing were slower to get addicted. Our Customer Success team worked individually with these strike team members on their own addiction and adoption, oriented around the time savings they’d face by no longer having to constantly respond to product content requests from their colleagues in sales.

When the ecommerce team and product marketers had adopted Salsify across half a dozen brands and nearly twenty online retailers, our Customer Success team scheduled an on-site training to introduce Salsify to over 200 internal sales managers and field sales reps. Building on the adoption of key marketing and eCommerce teams, the sales team readily got addicted to the ease of setting up new products with their online retailers.

Over the following six months, the sales team moved from addiction to adoption to absorption across individual account teams. Salsify’s absorption across the ecommerce, marketing, and sales teams paved the way for company-wide adaptation to new applications. The absorption of Salsify across these three key teams then paved the way for adaptation on an account-wide level, as the customer expanded their Salsify use to distribute product pricing information and enabling sales team members with Salsify interactive digital catalogs.

Cross-customer Influences and the 4As Network Effect

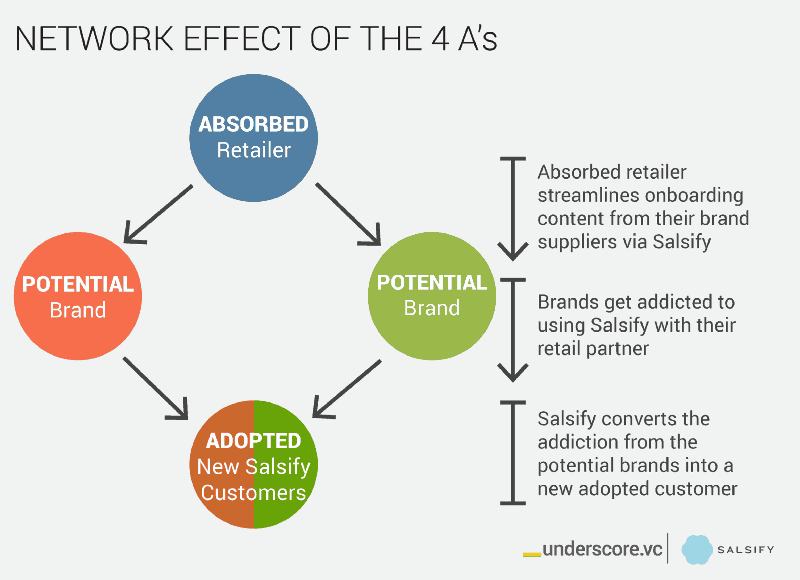

The 4As framework for customer success is not limited to giving guidance on how to drive expansion within customer accounts. Indeed, addiction, adoption, absorption, and adaptation can spread not just within a company but from one company to another.

This is particularly true in a business in which network effects across customers help promote increased value for new prospective customers. And just as a Customer Success team should identify and drive towards triggers for individuals and teams within an account to help spread addiction and adoption to new individuals and teams, so too should a Customer Success team invest to encourage heightened levels of success for customers who may help advance other customers along the 4As.

At Salsify, our customers include brand manufacturers, distributors, and retailers, many of whom do business with one another. Our brand customers use Salsify to help publish high-quality product content to their retailer partners; our retailer customers use Salsify to rapidly onboard content from their supplier brands; and our distributor customers do both. This is a natural network effect, as any brands that supply products to retailers who use Salsify benefit themselves from also using Salsify. Similarly, retailers who do business with a critical mass of suppliers using Salsify benefit from acquiring product content themselves with Salsify.

The key to leveraging customers’ progress along the 4A curve to help acquire new accounts and drive increased adoption within existing accounts is to choose the right customers. In a network-effect business, this means prioritizing absorption in customers who are highly-connected hubs within your network. These are the customers whose absorption of your products will yield the most benefit in helping prospective customers take the first steps towards addiction or existing customers reach adoption or absorption.

Example: Driving Addiction in Furniture Manufacturers

A well-known furniture retailer in the western United States was struggling to get accurate product content from their suppliers. Suppliers would toil over complex spreadsheets, taking weeks to provide critical information necessary to start merchandising and selling their products. Making matters worse, information often came across incomplete and inaccurate, adding additional delays to an already drawn out process of bringing new collections to market.

The furniture retailer selected Salsify to improve the quality and speed of their content onboarding process. Our Customer Success team worked with the retailer’s strike team to clearly define their content requirements and to enable their suppliers to directly submit validated content to them via Salsify. The retailer quickly moved beyond a pilot with a handful of suppliers and rolled out Salsify to all 80 of their manufacturers, benefitting from product content with fewer mistakes received in days instead of weeks.

The rapid adoption and then absorption of Salsify by this retailer yielded benefits beyond the scope of a single customer. Individual sales managers at their suppliers were now using Salsify on a daily basis to send product content to the retailer. When Salsify reached out to these suppliers, this initial success motivated them to evaluate our other products, and several suppliers signed up to use Salsify for their full product content management and syndication needs.

The absorption of Salsify at one customer (the retailer) directly led to a level of addiction for individuals at other companies which in turn directly contributed to the adoption of Salsify by new customers. This is the multi-layered value of the 4As in action at its best.

Measuring the 4As

Many of the ways to evaluate the effectiveness of the 4As are standard SaaS metrics that have been written about extensively elsewhere. For example, we measure our ability to get new prospects addicted to Salsify via standard conversion rates through our marketing and sales funnel.

Diving a level deeper to understand your customers’ progress along the 4As curve can help Customer Success teams verify — or refute — qualitative assessments of individual accounts’ success deriving value from your product, and it can also help give you a macro look at how effectively your team is tackling The Power of One Or Many challenge.

To measure the 4As, ask yourself what are the typical behaviors and consequences you’d notice from individuals, teams, and companies who are moving successfully through your customer journey. Remember that different people experience addiction, adoption, absorption, and adaptation at different times, and choose appropriate metrics that reflect this.

Measuring addiction

Initial addiction typically falls under sales’ purview. As we said above, at Salsify we measure initial addition by looking at prospects’ progression through our sales funnel via indicators such as conversion rates, lead scoring, engagement with Salsify during a trial, and sales cycle length. But addiction is also critical for new individuals and teams even after a company signs up as a customer. To spot signs of this sort of subsequent addiction, we look at product usage data: Have new users logged into Salsify? Have they logged in repeatedly? Combining this basic usage data with an understanding of your customer’s organizational setup can give you a strong indicator of when new people and new teams are getting addicted to your product.

Measuring adoption

Customers adopt your product when they use it regularly to accomplish valuable business goals. In line with this, measuring adoption means measuring product usage. For meaningful adoption, however, it’s important to move beyond measuring basic engagement metrics such as login, page view, or event counts. Usage data should align with business value to give a clear assessment that an individual, a team, or a company have adopted your product in a meaningful way throughout their business processes.

Brand manufacturers initially purchase Salsify as a product content hub to accomplish a variety of goals. Some companies are primarily looking for a centralized, collaborative, repository to create and manage high-quality product content and imagery. For these customers, we look at usage data around searching and viewing product content, advancing products through content and approval work flows, and updating product details. Other companies’ initially focus on using Salsify to share product content with their retailer partners. For these customers, we look at different usage data: we look at the frequency and breadth with which they’re using Salsify to publish content to their retailers. The key observation here is that adoption doesn’t happen in a vacuum: it needs to align with business goals that are important for a particular team or account, and it should be measured as such.

Measuring absorption

To measure absorption, look at the key indicators of uses of your product that go beyond the initial team that purchased and adopted your product. Absorption can proceed along various axes, and identifying the way in which your product use can evolve from team or department-based usage to more broad-based usage throughout an organization is critical. This will help you in understanding how embedded, sticky, and valuable your product is to a customer.

At Salsify, we look at the extent to which Salsify has been absorbed into an organization beyond the initial team that purchased it. For example, when a customer who initially purchased Salsify to help syndicate product content to their retailers begins using Salsify workflows to gather product content during their new product introduction business processes, that’s a sign of absorption above and beyond basic adoption.

Another axis of absorption occurs when a software product moves beyond usage as a standalone application and is embraced as a platform. For example, one year into their lifecycle with Salsify, an IT team at a major kitchen and bath products manufacturer reached out to our Customer Success team to learn how they can use Salsify APIs to integrate Salsify with multiple systems ranging from real-time inventory data from their ERP system through to real-time product content lookup via Slack for their Customer Service Representatives. This level of integration indicates absorption of Salsify within the day-to-day business processes of the organization.

We also measure usage of Salsify across different brands and regions of a manufacturer. A multinational CPG company adopted Salsify as a product content hub for half a dozen core household cleaning brands. Six months later, they expanded their usage by adding ten new users and one thousand products from their food and beverage brands into Salsify. This clear mark of absorption acted as a trigger to engage regional teams from South America, Europe, and Russia in conversations around their product content challenges, paving the way to new layers of adoption and the significant expansion revenue that goes along with that.

Measuring adaptation

Adaptation is a two-way street. In some respects, it can be measured purely on the basis of net revenue increases as existing customers purchase your new products and begin to adopt and absorb them throughout their companies. On the other hand, adaptation can be an ongoing process that involves continual dialogue with your customers to better understand their new challenges and opportunities and to bring new products to market that provide substantial incremental value.

In addition to tracking our ongoing upsell opportunities and results, we also measure both engagement and product usage metrics that lay the groundwork for future adaptation of our products for customers.

On the engagement side, we set goals for engaging our customers in Executive Business Reviews (EBRs); one key aspect of each EBR is conversations between our customers and the Salsify Product Management team that help us build a deep understanding of our customers’ needs and influence our product roadmap appropriately.

On the product usage side, we measure usage of aspects of Salsify that tie into additional benefits offered by modules or products that a customer is not currently licensing. For example, a manufacturer that uses Salsify primarily for syndicating product content to retail partners and then starts to store their product images as well may be in position to expand their use of Salsify to include our digital asset management (DAM) module. A retailer that uses Salsify primarily for product content management but is regularly ingesting spreadsheet content from suppliers may be in position to expand their use of Salsify to include our content onboarding product that streamlines collecting high-quality product content from suppliers.

The key takeaway here is that while the results of adaptation can be directly measured through new product upsell revenue, this stage of the 4As requires anticipatory and predictive measurement to work in partnership with customers to support meaningful adaptation towards significant new business value.

Measuring Overall Progress

Each of the above suggestions can help you measure your status and success along each part of the 4As lifecycle. In the end, using the 4As to help solve The Power of One or Many challenge is only as good as the end results it drives for your customers and for your business.

To that end, it’s critical to constantly measure, report on, and respond to the overall health and growth of your customer base in aggregate. At Salsify, we capture a variety of standard metrics to track customer progress, including customer health scores, net promoter score (NPS), time-to-onboarding, usage aggregates, and more.

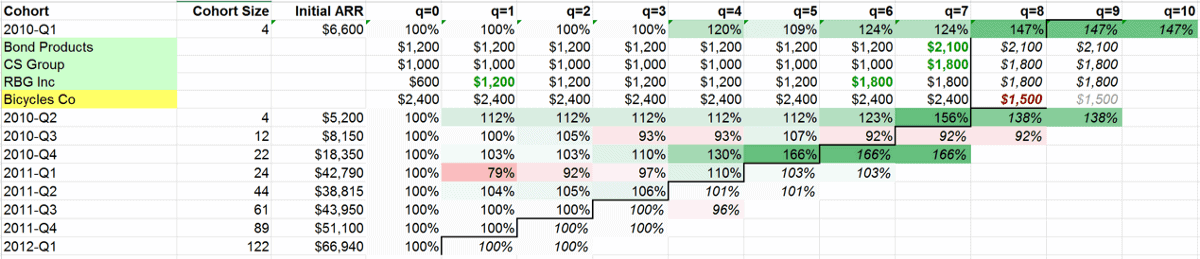

But perhaps the single most important measure of our performance that we rely on is a quarter-by-quarter view of our customer retention and net revenue growth, visible at both the aggregate level and the individual customer level.

In many ways, this is a classic SaaS cohort analysis, comparing quarter by quarter the retention rates and net ARR change of customers acquired at different points in time. However, there are a few specific things that we do in this analysis to help us understand both the big picture and individual customers’ progress along the 4As curve:

- Our cohort analysis allows us to drill into the details to see the quarter-by-quarter trajectory of individual customers that belong to each cohort. It’s crucial that we understand not only how our strategies perform in the aggregate but also to look at the progress of individual customers that contribute to that aggregate.

- We use our customer health information as well as expansion and upsell opportunities (the results of absorption and adaptation) to project both retention and net ARR change into the future.

- We apply the same analysis to cohorts defined in ways other than by customer acquisition date. For example, we look at our customers by company size, by products used, and by primary business driver, among others. This helps us identify dimensions along which our 4As strategy is (or is not) performing effectively.

The 4As in Action

We’ve seen how recognizing the importance of the 4As at the individual, team, account and cross-account levels yields a playbook for a Customer Success team to properly focus their time and energy in a high-growth B2B startup with mid-market to enterprise customers.

To put these strategies in effect as you build a Customer Success team, you need the right people. Different skills help fortify each of the 4As, and recognizing those roles will help you assemble a team that can crack The Power of One or Many challenge.

Your team will likely include sales reps properly supported by consultative pre-sales engineers who together can map your product’s benefits onto a prospective customer’s needs in a compelling-enough fashion to drive initial addiction.

Your team needs onboarding experts who know your product through-and-through and are laser-focused on helping new customers achieve the early wins that lead to individual and team adoption.

You’ll need Customer Success Managers (CSMs) and Account Managers (AMs) who can work in tandem to layer together team adoption curves to reach account-wide absorption and to capitalize on adaptation opportunities. Your CSMs should be strong customer advocates and project managers, holding a customer’s hand as they plan and execute for roll-outs to new teams and for new use cases. Your AMs should build trusted, strategic relationships with senior decision makers at your customer, understanding customers’ strategies and helping to identify opportunities to deliver additional value through expansion or upsell.

The Power of One or Many challenge is a challenge of priorities. Go deep too soon or too often, and you won’t have a broad enough customer base to help drive a critical mass of adoption. Focus on breadth exclusively and you’ll cap the potential value of your accounts and won’t develop the lighthouse accounts who help drive new customers to your products.

By understanding the 4As and using them to drive Customer Success strategy, you can conquer this challenge and grow individual accounts and your customer base across a market.