Today, Intercom has 30,000 customers, employs hundreds of people around the world, and has raised $241 million in funding. But back in 2011, it was just a simple messaging app. Des Traynor, Intercom Co-Founder and Chief Strategy Officer, and his user experience team built the tool to solve their own internal problem: They needed a better way to communicate with customers.

Despite its simplicity (or perhaps because of it), Intercom’s popularity caught on like wildfire. While the product was still in a closed beta, the team had a thousand businesses on the signup waitlist. They were #1 on Hacker News. And when they eventually started charging for the tool, users started paying right away. “We clearly understood the problem, and everyone clearly wanted the solution,” says Des.

One conversation stood out in particular. Des recalls Skyping with a contact who had recently started using Intercom. Rather than opening with the standard pleasantries of a catch-up call, this contact launched into an impassioned rant about how much he loved the product.

“This thing is awesome! I’ve been talking to customers all day, I’ve received seven feature requests, I already itemized them.” This contact went on and on about the tool’s impact on his business. Des sat back and thought, “Wow, we’re hitting into a really deep vein of demand.” Intercom was reaching product-market fit (PMF), and it was happening fast.

Finding a Clear Cluster of Demand (MVS)

What made this quick adoption possible? To Des, achieving PMF boils down to finding a clear, consistent cluster of demand.

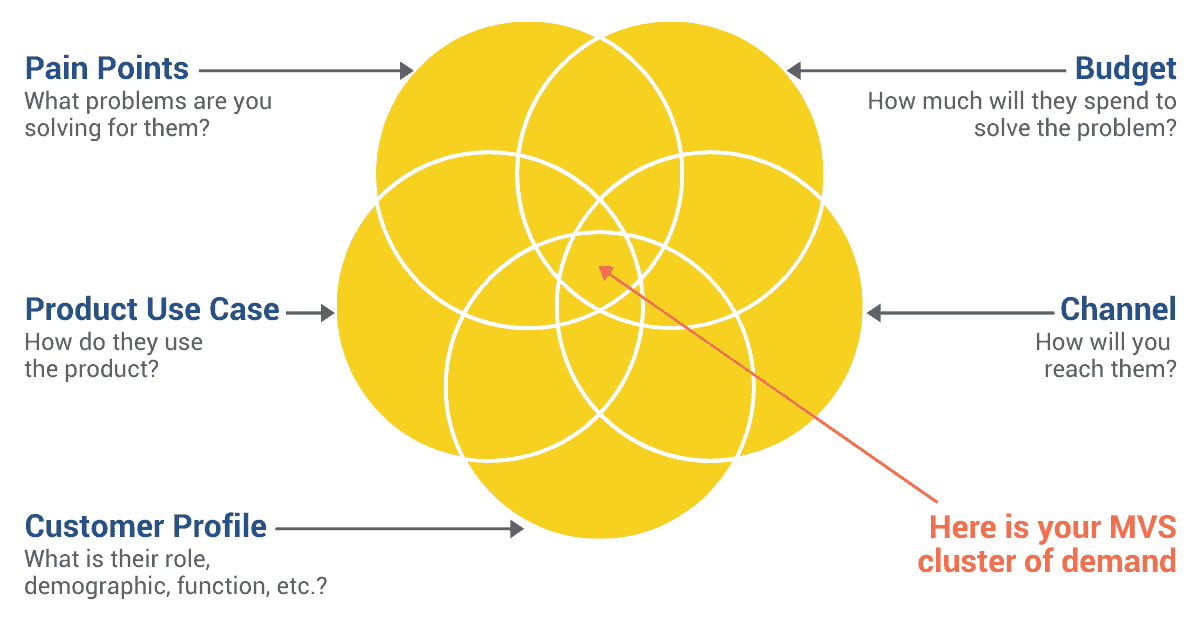

Called Minimum Viable Segment (MVS), Des defines a cluster of demand as having “a load of similar people, with roughly the same problem, who are using your product in roughly the same way, willing to spend money to get the job done, and who you can reach through one primary marketing channel.”

Once you can hone in on this MVS cluster, you can build your business within a consistent set of constraints.

“In a dream world, you build only one feature and everyone uses it the same way,” says Des. Your Minimum Viable Product (MVP) is simple, but it perfectly fits the needs of your MVS. “That gives you a really small technical footprint and a really large revenue base.”

''In a dream world, you build only one feature and everyone uses it the same way. That gives you a really small technical footprint and a really large revenue base'' - @destraynor, Co-founder of @intercom. Click To TweetWatch out: It may be tempting to add new features or expand to new marketing channels to acquire new customers. But this can be a slippery slope, and this growth can give startups a sense of false hope. “You’re diluting your core offering just to chase any customer,” says Des.

“For most startups that have the illusion of success, the cluster unbundles,” says Des. He sees startups with multiple ways of acquiring new customers and a dozen distinctly different use cases. “You’re a blogging platform to one customer, an internal doc to another, and a wiki for another,” says Des. “When no two customers use it the same way, that’s unbundling.”

The result? You’ll have to build a tremendous amount of software, and you may struggle to extrapolate the maximum value from each piece you build.

So, how do you find this cluster of demand? Focus on four steps.

1) Deepen your customer understanding

2) Segment relentlessly

3) Measure and prioritize ruthlessly

4) Remember to launch

1. Deepen Your Customer Understanding

As you identify a cluster of demand, continue to talk to your customers. “It’s a trite message, but it’s so important,” says Des.

As a product born out of their own problem, Intercom had a head start. “Every single problem that customers would tell us about, we had also experienced,” says Des. Product design flowed naturally, and choosing the first 10 features to build was “quite obvious.”

But after about a year of targeting B2B SaaS customers like themselves, Intercom shifted to a lesser-known B2C customer audience. “It was an interesting fork in the road,” recalls Des. The team was no longer on a “mental auto-complete,” and they started forming user research and product management teams.

To maintain PMF while growing, Intercom collected an incredible amount of customer feedback, at one point conducting 100 hour-long customer interviews. Through these interviews, they learned that customers had three primary goals for using Intercom.

- Sales: These businesses needed to grow sales, and they needed to communicate with prospects.

- Retention: Their users were signing up but quitting, and they needed a new feedback channel.

- Support: They were providing ineffective support and had tons of unhappy customers, and they needed to understand why.

These three priorities have guided Intercom’s scoping decisions for nearly a decade.

To deeply understand your cluster of demand, dig into:

- Profile: What is their role? In what function? In what industry? On which demographics will you focus? How educated are customers about existing solutions?

- Pain Points: What problem are you solving for them? How severe is the problem? What are their broader business goals? How will your product make their job easier? What consequences occur if the customer doesn’t find a solution?

- Use Case: How do they use your product? From their perspective, what is its value?

- Budget: How much will they spend to solve this problem? What do they expect to spend?

- Channel: How will you reach them? Where do they spend their time? How do they learn about new products or service offerings?

2. Segment Relentlessly

As you dive deeper into customer discovery, you’ll get far-ranging responses. Some customers will say a feature is terrible. Others will say it’s great. “Chaos is the nature of the world,” says Des. Your customer feedback will likely be no different.

“If everyone loves it, that’s good, and if everyone hates it, that’s also good,” says Des. “But if it’s all over the place and you can’t explain it, that means you’ve got too many different types of use cases and people.” You don’t have a clear cluster of demand.

''If everyone loves your product, that’s good, and if everyone hates it, that’s also good. But if it’s all over the place and you can’t explain it, that means you’ve got too many different types of use cases and people.'' - @destraynor Click To TweetIn this case, try putting feedback back into one bucket and segmenting it in new ways. Des mentions using a technique called phenomenography, the study of how people experience, conceptualize, and understand things. “There’s always a signal there, and you’ll work it out if you just keep trying.”

You can break down feedback in many different ways. A few examples include:

- Company Size

- Vertical

- B2B or B2C

- Pricepoint

- Feature Use

- Persona

- Customer Awareness

“Keep going until you find sense in the chaos,” says Des. “Feedback is just noise until you segment it.”

3. Measure & Prioritize Ruthlessly

To Des, the best way to prioritize requests and measure PMF is by tracking Net Dollar Retention (NDR), sometimes called Dollar Revenue Retention (DRR). All new features or initiatives can be reviewed by thinking, “Will this help NDR?”

But in the earliest days, you might not have much NDR to measure. (Plus, NDR isn’t always the most inspirational metric. “You have to do some linguistic gymnastics to make sure people care about NDR,” says Des. “In and alone, it’s not a great north star.”)

Instead, Intercom found another way to track data and prioritize product advancements: tying it back to the company’s mission to make the internet more personal.

“Aligning the metrics to the mission was important because it gave everyone clarity on what we were trying to do—without becoming a team that’s motivated only by improving metrics,” says Des. This broke down into three customer-focused buckets:

- Growth: How many businesses are using us to connect with their customers?

- Performance: How many customers are businesses communicating with?

- Behavior: How many conversations are businesses having with their customers?

Des says everything Intercom does impacts one of these goals: get more business customers, start more conversations, or attract more end users.

4. Remember to Launch

After all this strategizing, segmenting, and analyzing, don’t forget one of the most important steps of all: launch.

“I’m still shocked by companies that spend so long terrified the market might reject them,” says Des. “They decide the best way to cope is to never ask the market to accept them, so they never launch, and that way they never really fail. Except that by not launching, they do!”

“Don’t waste time being afraid,” he adds. “You’ll learn so much more by launching than you will by theorizing in your head.”

To tie it all together, finding an MVS cluster is a critical step to achieving PMF. If you can find a niche group of people with the same profile, needs, product use cases, budget, and channel accessibility, you’ll have the opportunity to build a product that truly fits. From there, you can iterate and expand.

How are you going about finding PMF? Or if you’ve already hit that milestone, how does this compare to your own experience? Let us know by leaving a comment below, or reach out at hello@underscore.vc.