It seems obvious: When fundraising, of course you should ask folks in your network for investor intros. This stuff isn’t rocket science.

But here’s the thing—while you can approach this process thoughtfully and strategically, many founders don’t.

VCs get hundreds of cold inbounds every week. When an inbox is flooded with emails, a warm introduction from a known, trusted contact makes a huge difference.

In the following video, Underscore VC Partner Lily Lyman gives an overview of how to approach VCs for funding.

If you’re looking for investors, the proof is in the process. Running a streamlined fundraising process shows that you’ve got your act together—and that sets you apart.

Remember: Start this process early—well before you are actively raising. The sooner you begin getting to know investors, the more time you have to explore the relationship—and determine if they are the right investor for you and vice versa.

That starts with your own research. Think about companies you respect, or companies with a similar business model or in a parallel industry (but make sure they’re non-competitive). Who invested in them at your stage? You can usually find a fair amount of this information on Crunchbase.

But don’t miss out on other warm connections that may not be on your radar. To get started, try the following steps.

1) Ask Fellow Founders

Look beyond your current investors to get input and intros from other founders or startup operators. Ask them: Who is your most helpful VC?

Intros from other investors are powerful, but an intro from a founder an investor knows and respects is gold. “This is especially impactful if it’s a founder who has a right to an opinion on the problem you’re solving,” says Brian Devaney, Senior Associate at Underscore VC.

2) Mine LinkedIn

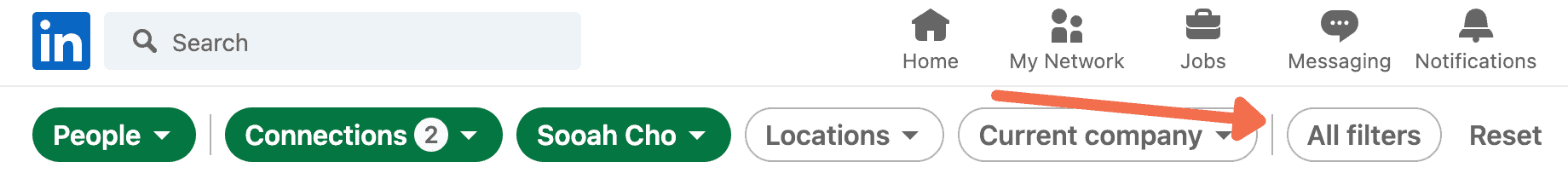

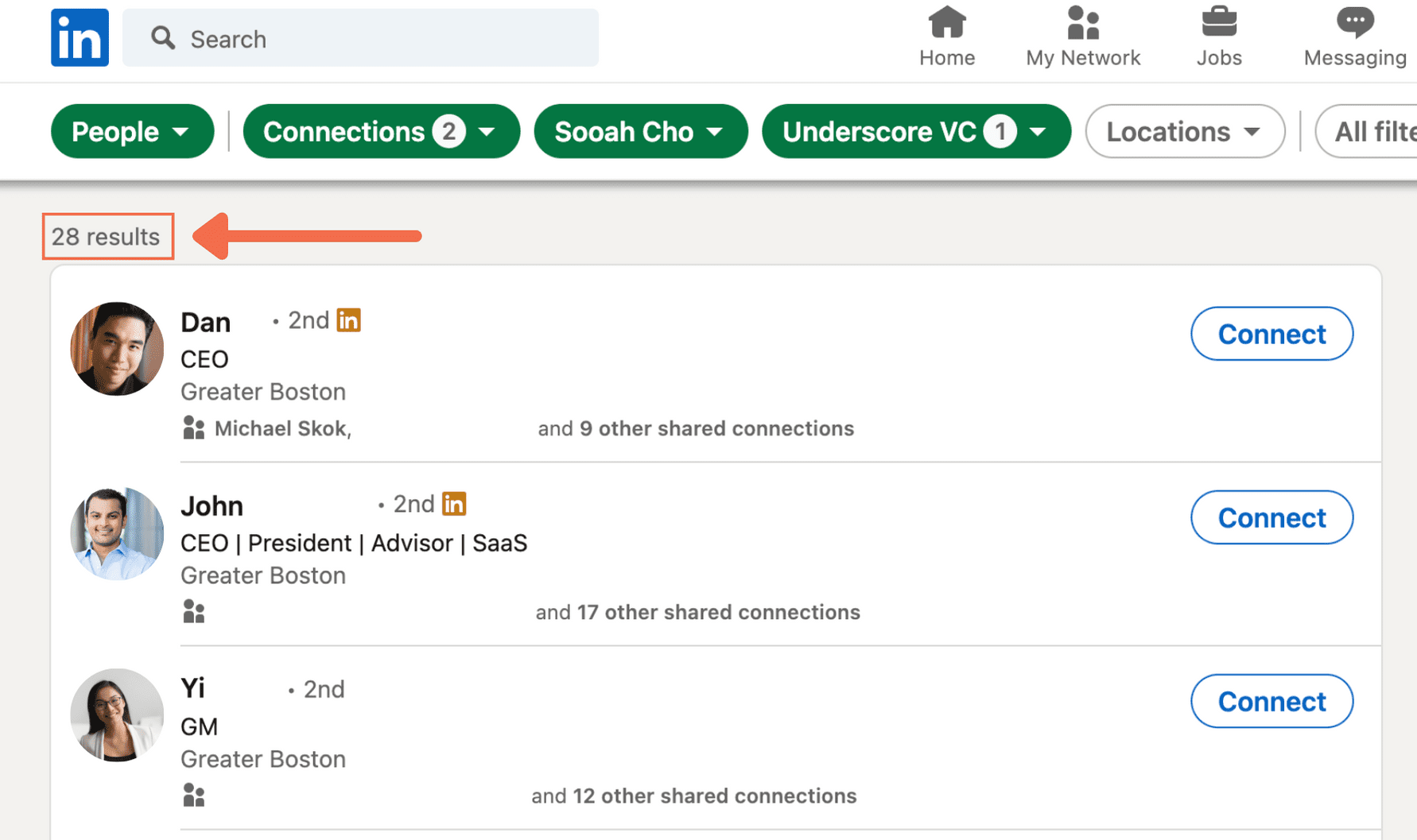

For a more direct view of a contact’s network, take to LinkedIn. It’s easy to do, and LinkedIn enables you to search at a very granular level.

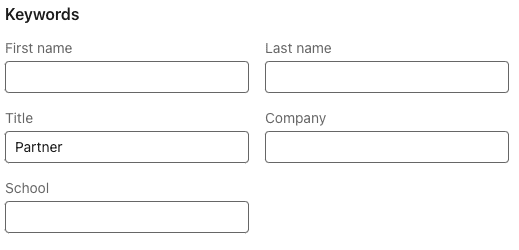

When you see a list of your contact’s connections, you may be looking at a thousand people. To keep things efficient, use LinkedIn’s search filters.

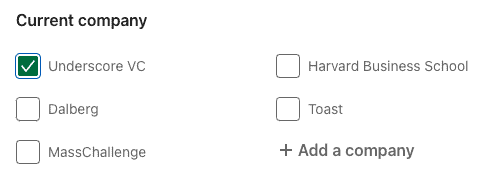

You might try to search for specific VC firms.

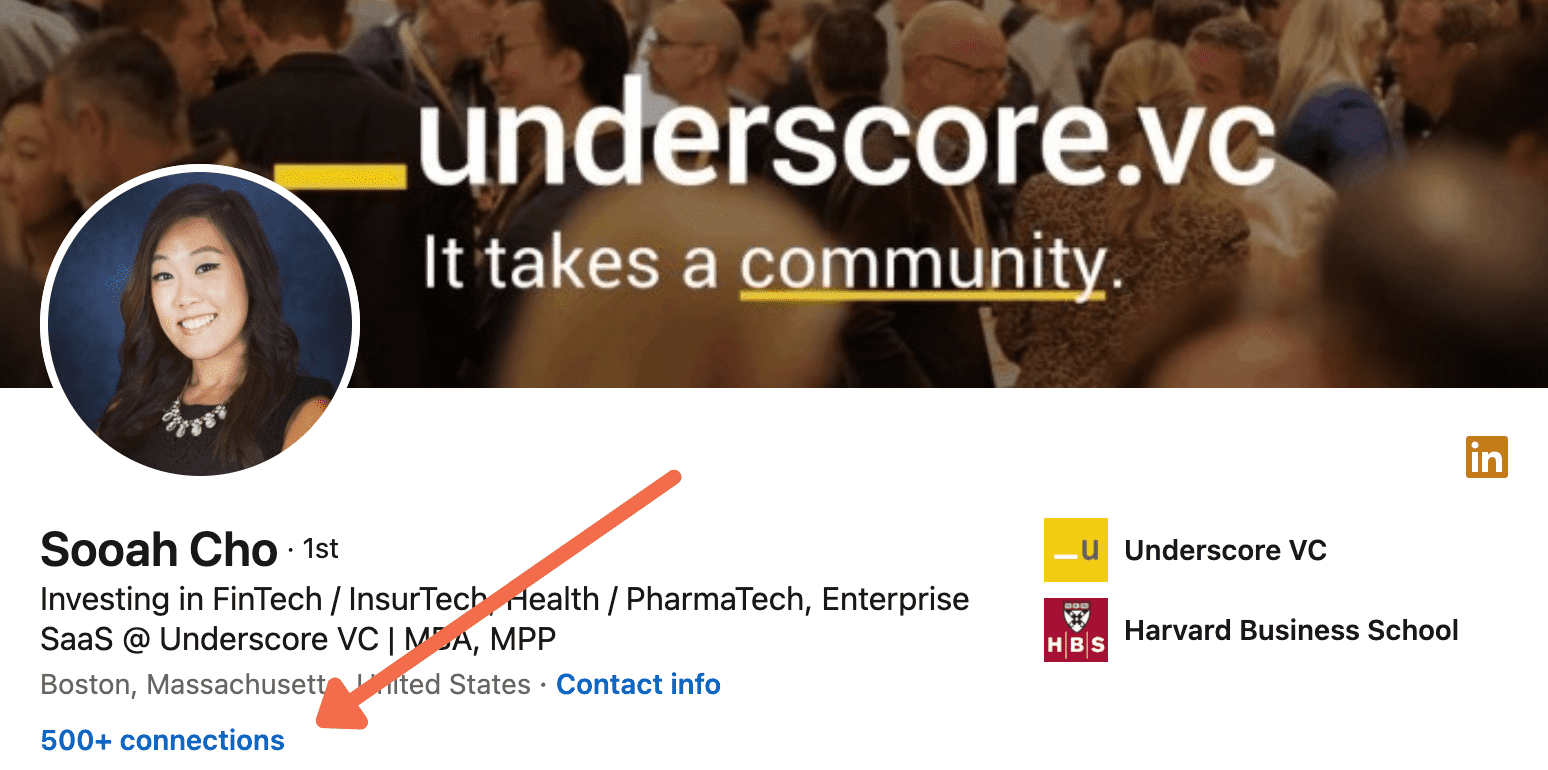

“When looking through mutual connections to request warm intros for, it’s always best to prioritize folks who can strengthen your credibility,” says Sooah Cho, Principal at Underscore. “I trust and appreciate warm intros from my contacts who can personally make the case that this is a rockstar founder based on a prior working relationship or someone with deep expertise in the founder’s market.”

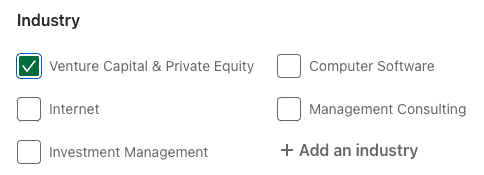

You could filter by industry more broadly.

Or you could filter by title: Investor, Principal, Partner, Senior Associate—anyone who could help you get your foot in the door.

In the end, you’ll see a list of connections to vet as potential investors.

→ As you find potential investors, keep track of names, notes, and contact information in our simple investor CRM built in Coda.

3) Research This Specific Investor

Before you ask for an introduction, spend some time researching this investor. Be ready to articulate why you want to speak with this specific person at this specific time.

- What areas of expertise can they offer you?

- What do you have in common with them?

- Have they invested in companies you know and respect?

This information will help you prepare for the conversations that may follow.

Startup Secret: When looking for a warm intro, aim to get introductions from investors one stage before or one stage after your current fundraise—or same-stage investors that are non-competitive (i.e., a software investor recommending a hardware company).

“Same-stage investor intros can bring up slightly negative questions,” says Brian. “It can make you wonder, ‘Why are we getting their leftovers? Was this deal not good enough for them?’”

4) Make the Ask

The clear next step is to make the ask. That’s as simple as sending a brief email with an offer to draft the intro for them. “You could even tie it into one of your regular investor updates,” suggests Keith Corso, Founder and CEO of BusRight.

##

Subject: Yearly/Quarterly Update from [Startup]

Hi [Name],

I saw that you’re connected with [Investor Name, Firm Name] on LinkedIn. Do you know them well enough to make an introduction?

If so, I’d be happy to share a drafted intro note with you.

[Traction That Suggests You’re Gearing Up for Your Next Round]

- Progress against milestone 1

- Progress against milestone 2

- Progress against milestone 3

Thanks,

Founder

##

“Asking them if they know the contact well enough shows that you respect their relationship dynamics,” says Keith. “Plus, by allowing them to easily opt-in or opt-out, you build further trust with this person.”

5) Draft Personalized Notes

If they opt in, make it easy for them to help you. Enable your contact to copy and paste your draft and hit send. You can also get creative; record a Loom video with a very brief introduction about your startup and traction thus far.

Tip: Confirm whether or not it’s OK for them to include your pitch deck in the email.

Keith suggests a draft like this:

##

Thanks, [Name], for passing this note to [Name].

—

[Name], it’s great to be connected to you. [Personalize the note: Do you know someone in common? Have they said something positive about them? Have you worked with their product before? Show that this isn’t an email blast sent to every other investor.]

I started [company] to [mission].

We have [1-2 stats to show traction]. We are working to [reach this next milestone].

Are you available next week for an informal get-to-know-you chat? I would also be curious to learn more about [topic they’re an expert in], as we work toward [relevant goal].

Best,

Founder

##

As you start these conversations, remember to keep notes on your interactions. (Tip: A CRM for investors helps keep all this information organized.) From here, you’ll be on your way to building investor relationships.