Imagine: Your company is gaining great traction. Your go-to-market motion is starting to feel repeatable, and top-tier investors are excited about the possibility of an amazing deal. They’re eager to participate in your Series A funding round, and in the end, you have your pick of investors.

That’s the dream. However, for some founders, that might not always be the reality. We created this Series A funding guide for reality—to help entrepreneurs prepare to fundraise, select strategic milestones, run a tight process, and tell the right story to attract strong investor interest.

This guide is a living, breathing document. We’ll continue to update it with new examples and ideas, and as you go through the Series A fundraising process, we would love to hear your feedback and suggestions.

We’ll start with the basics.

What is the Difference Between Seed and Series A funding?

Series A funding was once thought of as a company’s first significant round of early-stage venture capital financing. But today, that may no longer be the case. Seed rounds are larger than ever, with Series A rounds expanding as well.

How Much is an Average Series A Round?

The median Series A in 2021 was $13 million—2.5x bigger than it was in 2010—while the median Seed in 2020 was $4 million. Increasingly, Seed capital is a company’s first significant round of venture capital financing.

All that aside, the evolution of these values highlights another point. Building a business can’t be broken down into neat stages. Instead, think of it as a vector. You start somewhere, head in a general direction, and build momentum as you grow.

The fundraising process is the same. It’s impossible to know exactly how much capital this journey will take. Instead, outline milestones and estimate how much it’ll take to get from one to the next.

How Long Does it Take to Raise a Series A?

The short answer: It depends.

It depends on the connections and intros you can get to investors, how much traction you have, how well you can tell a story, and a host of other factors (which we’ll cover later in this guide).

Series A funding planning and preparation could take around six months, but the actual process of formally pitching investors could be as quick as a few weeks. But one thing always remains true: As you close each round of funding, you should be thinking ahead to the next round.

When Should You Raise a Series A?

The same answer applies to most funding rounds. Raise Series A funding when you know what you’ll do with it. Not when you’re running out of cash.

Startup Secret: If you don’t know what you’ll do with the cash, then you probably shouldn’t be fundraising.

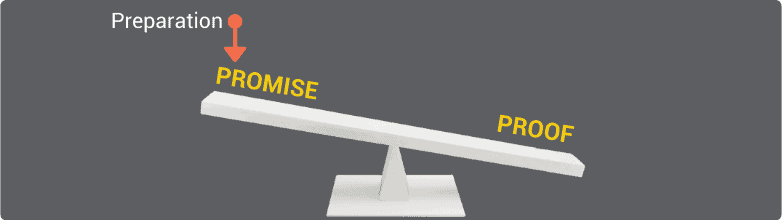

But this question is often more about, “What does my business need to look like to get investors on board?” For that, you can fundraise with all the promise or all the proof.

Raising on promise = targeting a massive market ripe for disruption, showcasing a rockstar team, showing a path to traction, and proving you are “the one” do be doing it.

Raising on proof = reaching product-market fit, with revenue numbers and plenty of customers to prove it.

“Think of it like a seesaw,” says Michael Skok, Underscore VC Co-founding Partner. “How will you get to the right balance?” If your proof is lower, you’ll want to double down on your promise, which probably means you’ll need to double down on your preparation.

At the Seed stage, it’s often too early to have a ton of proof, so you’re raising more on potential. If you pitch right, it can seem like the sky’s the limit for your venture—and investors will feel your excitement.

Fast forward to Series B funding, Series C funding, and beyond. At these later stages, it’s all about proof. You understand the customer so well, and your company’s value is so obvious to them, you drive repeatable, sustainable growth with healthy unit economics. The proof is in your numbers.

But for a Series A? It may not be clear. In 2020, 77% of startups that raised a Series A were generating revenue. To get a bigger check, you need more than just promise, but you might not yet have all the proof. That makes a Series A round a bit of a balancing act.

Are You Ready to Raise Series A Funding?

Are you raising on promise or proof? Consider the following questions in this fundraising self-assessment:

1. On a scale of zero to 10: How is your business performing?

Put yourself in the shoes of a top-tier investor. Think about their end goal, to deliver a return on their LP’s investment.

2. On a scale of zero to 10: How attractive are you to a top-tier investor?

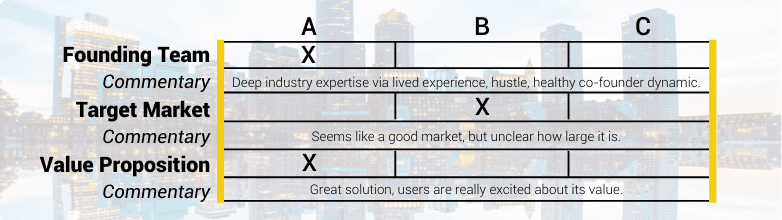

Think about your track record. For example, Underscore rates founders on a three-point scale across key categories such as founding team, target market, and value proposition.

For our full scorecard, reach out at hello@underscore.vc.

Now that you have your self-graded scores, think about context.

3. Why did you give yourself these ratings?

This could sound like, “Hey, we’re performing well, but we wouldn’t be attractive because we haven’t got A, B, and C.” Or, “Well, our performance isn’t as strong as we’d like, but investors would still be interested because of D, E, and F.”

4. Are your ratings in line with your Seed investor’s perspective?

If not, why?

If you’re a 10 on both scales—and your existing investors agree—congratulations. You’re likely in for a smooth ride.

But if you’re like the majority of startups, your ratings may vary. While the process you follow generally remains the same, your preparation—and the way you tell your story—may need to shift.

When ready to raise Series A funding, start by thinking through your process.

How to Raise a Series A Round

It’s a powerful position to be in when investors proactively want to get in on a round. But if you don’t have strong proof, you have to drive this FOMO in other ways. That begins with a streamlined process.

Without one, things go off the rails. “You’ll start talking with different investors at different times, which means working on multiple timelines, which leads to getting term sheets at different times,” says James Orsillo, Underscore’s Operating Partner. “That’s far from ideal.”

To an investor, the process is proof. How you drive meetings, respond to pushback, integrate feedback, follow up, and more—they all send signals about who you are as an entrepreneur. That’s why it helps to:

Know Your Ideal Outcome

Not just the outcome of your fundraise—the outcome of each and every interaction with an investor. As you go into your first interaction, think about what you would want from a second interaction, and align your talking points accordingly.

Startup Secret: If in doubt about how the process moves, don’t guess. Just ask! “What would it take for you to be comfortable with bringing this to the partnership?”

Ask Smart Questions

“By asking smart questions early in your relationship, you can create a more balanced power dynamic,” says Lily Lyman, Underscore VC Partner. “Questions like, ‘What’s your thesis on this space?’ or ‘Where do you see the market going?’ signal, ‘Hey, I have choices. I want to work with somebody who is going to be additive and shares my vision.’”

Focus Your Follow Ups

When you’re being asked dozens of questions—whether they’re around competitive analysis, product roadmap, or future plans—you might not have every answer memorized. That’s OK. But follow up quickly.

“If the entrepreneur replies the next day, that instills confidence in them,” says John Pearce, Underscore VC Co-founding Partner. “On the flip side, if it takes a week, that reflects poorly on the entrepreneur.”

Keep Everyone in Lockstep

Make sure you understand each investor’s process and the timing of a term sheet. To drive a competitive process that results in a few offers, aim to keep everyone in lockstep and at the same pace. That way, you can compare your options and select the best one.

Meet and Build Relationships with Venture Capitalists

Effective fundraising comes down to relationships, and the key to building relationships with Series A investors is to start early. Kick off conversations long before you’re ready to raise. That way, you have time to build a real relationship—and qualify an investor as a good fit for your business, or not—without feeling pressured for cash.

In many ways, the process to raise Series A funding is like a B2B sales process: research prospects, qualify leads, get to the next level of the process, and manage your pipeline.

As you pull together your target investor list, follow companies in a similar space, see who invests in them, and ask around. This research should lead you to a shortlist of potential investors.

The Best Ways to Connect with Investors

By far, the best way to connect with an investor is via a strong introduction from a mutual connection. Take a look through:

- The investor’s portfolio companies: Do you know a fellow founder who could refer you?

- The investor’s co-investors: Do your current investors have a connection?

- Your CEO or founder networks: Have they pitched this investor in the past, and did they maintain their relationship?

- Your peer network: Do you know anyone with a past work or alumni connection to this investor?

Startup Secret: To ensure the introduction gets the right attention, make sure your connection pre-warns the investor, so they know it’s coming before it arrives in their inbox.

If you don’t have a direct connection to an investor:

- Engage with them online (VCs are notoriously active on Twitter).

- Attend the same conferences or virtual events.

- Figure out where they’re speaking and approach them with a thought-provoking question.

- Find mutual LinkedIn connections.

- Or, in the case of Underscore, find a connection through the Underscore Core.

Once you build that list and make initial contact, qualify them and nurture relationships from there.

→ Read our full guide to building relationships with investors.

Throughout this outreach, don’t forget to bring your existing investors along with you. “They ought to be ahead of the process, not behind the process,” says John. “If they don’t have a clear understanding of your progress, then for them to be making introductions is rather hollow.”

Series A Milestones: What are VCs Looking For?

At this stage, do what you need to do to prove value to your customer. If you can do that, investors at VC firms will want to get behind you, and the funding will follow.

To outline specific milestones, we created a SaaS playbook for entrepreneurs broken down by broader themes: team, market, product, and go-to-market.

At Series A, Underscore typically looks for:

- Team:

- Visionary leadership (with the ability to dig into details)

- A founder who can get people on their side

- Building out a whole team (with self-awareness and sensitivity to understand who’s needed)

- Market:

- Increasing conviction in a large and growing market opportunity

- Understanding market drivers and the timing of how they will play out

- A deep understanding of all competitors

- Product Development:

- Enough experimentation with pricing and packaging to understand their drivers

- Evidence of product-market fit:

- High usage and low to no churn (or at least you understand the reason for churn)

- Customers would be disappointed if the product was taken away, and you know why they can’t live without it

- Validated by customer references (for B2B) or user engagement (for B2C)

- Go-to-Market:

- Repeatability in sales and marketing motion (supported by those customer references and that user engagement)

- “Land and expand” movement with customers—they increasingly use the product and pay for more capability (increasing dollar-retention rate)

- Shortening sales cycle

- CAC payback is decreasing and heading toward 12 months (so customers get value out of the product sooner)

Startup Secret: One of the biggest red flags at the Series A round is having outlier customers. Outlier customers suggest that you don’t have repeatability, and haven’t yet honed your minimum viable segment.

Note: You may not check all these boxes perfectly. Be honest about where you don’t and where you need help. Authenticity builds trust, especially with VCs. But be prepared to double down on the ones you do have, and be able to explain your plan for attaining the ones you don’t. More on that later.

Case Study: Series A Milestones

Arik Keller, Founder and CEO of Underscore portfolio company Mable, raised an $8.5 million Series A round in the fall of 2020.

Mable is designed to help grocery stores discover and buy from emerging brands and distributors. Through Mable’s B2B eCommerce platform, retailers have the ability to easily order from all of their direct suppliers and distributors in one place. Mable’s unique approach to this market is not to compete with distributors, but rather enable them with a modern purchasing experience for their grocery store retailers and brands.

There are 15,000 independent grocery stores in the US, and targeting each and every one would be costly and inefficient. Instead, Arik and team have chosen to support the existing infrastructure and supply chain incumbents. He shared the milestones that led the company to successfully raise Series A funding:

“We focused on a few specific milestones:

- The first was product-market fit. We’re going after a very tough business—a marketplace. So we needed to demonstrate that we were close to reaching product-market fit to gain confidence from investors.

- The second was around our customer acquisition strategy. For our Series A, most investors were looking for evidence that we had found an economical way to acquire retailers. This was particularly important given that we’re going after a long tail of small businesses.

To measure our progress toward these milestones, we focused on:

- # of Active Customers. This helped show adoption and product-market fit.

- Customer Retention. This is critical in any business, but especially so for a marketplace business.

- Customer Acquisition Cost. Every Series A round requires a good handle on this.

- Customer Cohort. Looking at our cohort allowed us to hone in on a segment of customers who were signaling our success in a particular segment of our industry.”

How Much Should I Raise?

Before estimating the costs of getting from one milestone to the next, consider your own personal preferences. That comes down to two key things: your tolerance for risk and your sensitivity to dilution.

Then you can think through $$$. Many of the basic principles of financial planning and forecasting are relevant here, but you don’t need to be a CFO to build out a smart plan.

- Think big-picture and long-term. Especially in the Seed to Series A stage, there will be a lot that you don’t know. But from what you do know, what will be your key driver of growth? Will you need to out-build or out-sell a competitor? Think about your end goal.

- Outline key milestones. Think back to the milestones you’ve outlined above. If you know what you need to do, then it becomes easy to plan your resources accordingly.

- Take stock of resources. Think about people, infrastructure, and data. Who will you need to hire? What systems or processes will need to be in place? What information will you need to collect in order to continue your progress? Then, the kicker: What will all this cost?

- Think through contingencies. What could go wrong? Covid-19 is an extreme example, but contingency planning will ensure you’ve got enough runway to reach your next milestone—even when things go awry (and they will!). What financial padding might you need?

- Track comparables. What’s the average time between fundraising rounds in your sector?

A financial plan will flow naturally from this process.

Preparing When You Don’t Have the Proof

The ideal scenario is that you have everything planned out, your timing lines up, and you’re not scrambling for cash a month before your runway ends.

But reality is rarely perfect. So what do you do if you don’t yet have the right proof, but you need cash?

“This is the essence of what good fundraisers do,” says Michael. “They become clear, in their minds, that they’re on the right track.”

First and foremost, you need a story that you believe in. Why are you committing your life to this business?

When you have that conviction, double down on the following key areas, and tell an inspiring story.

Rally the Right People

The #1 thing VCs back is people. So, if you need to dig into your promise, identify all the people who are considered “backable” (i.e. credible). If you don’t currently have them on your team, be honest about that with yourself, and get them lined up. Then shift your story to focus on your team’s credibility and why you’re uniquely positioned to win in your market.

This doesn’t need to be your co-founder—it could be someone less visible or more junior, like a CFO or even a board member. The reaction you’re going for is, “Oh, so-and-so is involved? She’s fantastic. I’ll take a look.” Who can you recruit that will get that response?

Pave a Path to Proof

Let’s say you don’t have the ARR or the user engagement data to show that you’ve nailed product-market fit. If you don’t yet have the numbers, you can shift your story to convey how you’re on the right path—that your progress so far isn’t an anomaly.

Think through:

- What will product-market fit look like for your business?

- What steps will you need to take to get there?

- How far are you on that path to repeatability?

- What’s left to do, and how will you do it?

Another great way to do this is to share a story about a failure and what you learned.

- Describe the situation.

- What went wrong?

- How did you course-correct?

- Share your learnings.

- How has that guided you on your path to proof?

Prove a Large Market

“Frankly, we don’t believe most market sizings,” says Michael. “Unless a founder can show us the value they deliver, customer by customer, it’s simply not relevant.”

Avoid the temptation to use broad market research or top-down market sizing (reading an analyst report like Gartner or Pew and throwing out a vague market number). Total available market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM) are meaningless until you can validate what a customer will actually pay for your product.

Startup Secret: Instead of grabbing stats off the internet, prove your market customer by customer, through a bottom-up approach.

Think through:

- What does a single customer look like?

- What is your value to them, and how much are they willing to pay?

- How many are there in a typical organization?

- How many organizations like that are there?

- What will it look like when you’ve captured this minimum viable segment?

- How will that set you up for further expansion?

As you tell your story in a pitch, articulate your plan for tackling this big market in a strategic, logical way.

Questions to Answer Before You Pitch

At the end of the day, fundraising comes down to a few key questions:

- How much cash do you need?

- Why is that a good use of funds?

- How will you de-risk over time?

- What milestones will happen with that cash to create value?

- What is your financial plan?

Startup Secret: Anticipate and ask yourself the hard questions before someone else asks them of you.

As you prepare for Series A funding, what are your weak spots? Have your answers prepared, rehearsed, and documented in appendix lines.

If you’ve built strong relationships with investors, ask them for feedback on your pitch. A simple, “Hey, here’s how I’m thinking of fundraising, and here’s where I have some gaps. Would you mind reviewing this with me and sharing feedback?” can go a long way. Some entrepreneurs might be afraid that asking for help will make them look weak, but when done right, this can show self-awareness and be a real value add.

Preparing Your Pitch and Materials

What are VCs looking for? Realistic optimists—you’re honest about how long something will take, but you think big when it comes to an outcome. Your Series A funding pitch should highlight both sides.

Tell a Story

Chances are, a startup funding pitch will be boring—unless you can turn it into a story. How did you find this opportunity? What challenges are you overcoming? How will you do it? Where’s the emotion?

Try to make it like a movie script. Bring it to life. Keep it authentic.

A helpful exercise is to write out your pitch narrative in a doc before you start to build slides. Synthesize your thoughts, smooth transitions, and tell your story before you get caught up in graphic design.

→ Try out our Pitch Narrative Template.

The Key Elements of a Series A Funding Pitch

Entrepreneurs have a tendency to cram too much information into one pitch deck. Instead, simplify and focus.

Think about: What is your intended next step? Just like a B2B sales process, you could plan a series of engagements over a certain timeframe. For example:

- Engage with an investor on social media

- Meet them at a conference

- Ask an “elevator question” to pique their interest

- Give a casual overview of the problem you’re solving

- Give your initial pitch

- Move forward to a second meeting

- Get to due diligence

For each of the potential steps above, what information can you share to get to that next step? Present only the information needed to drive that action. No more, no less.

Agenda

Set expectations for your pitch. What will you share in this meeting?

Team

Introduce yourself and your team to the investors.

- Founders: Describe your founder-market fit. Why are you the right one to tackle this opportunity? What relevant life experience led you to it? What was your specific insight or “aha” moment?

- Team: How do you know each other? What results have you driven together? Why are you powerful together? What stories can you share about your failures, hardships, and learnings?

- Management: If you have a management team, at what companies and in what positions have they worked? What $ value did they build?

- To Be Hired: Who else do you need?

- Board/Advisors: In what capacity are they involved? If an investor reached out to ask them for a reference, would their reference be additive? How would they pitch you?

Business Overview

Orient investors. Help them understand your vision and mission. Where are you starting? Where are you going? It helps to whittle this down to one crisp sentence.

“We do XX for YY by uniquely ZZ.”

Market Opportunity

For an investor to invest, there needs to be a huge opportunity. How will you turn your idea into a $1 billion business?

Consider the 4Us:

- Why is the problem Unworkable? Does your solution fix a broken business process where there are real, measurable consequences to inaction?

- Why is the problem Unavoidable? Is it driven by a mandate with implications associated with governance or regulatory control?

- Why is the problem Urgent? Is it one of the top few priorities for a company?

- Why is the problem Underserved? Is there a clear absence of valid solutions to the problem you’re looking to solve?

As described above, proving a large market can help showcase potential. Highlight this in your pitch by including:

- Bottom-up market sizing

- Analysis of your growth drivers

- Competition, which includes everything that competes for your customer’s attention, time, and money. What differentiates you from these competitors?

Value Proposition

Measure potential customer adoption with the Gain/Pain ratio. If you can’t deliver a 10x gain of adoption/pain of adoption, customers will typically default to inertia and will “do nothing” rather than bear the risk of working with you.

Beyond this ratio, show how your breakthrough is unique and compelling. What combination of 3Ds does your solution offer?

- Discontinuous innovations offer transformative benefits over the status quo by looking at a problem differently.

- Defensible technologies offer intellectual property that can be protected to create a barrier to entry and unfair competitive advantage.

- Disruptive business models yield value and cost rewards that help catalyze the growth of a business.

Go-to-Market Plan

Consider including a general overview of your marketing and sales funnel.

- What’s in your pipeline?

- How do leads and prospects move through it?

- What’s your marketing and sales model?

- How does this all sync with your business model?

Business Model

How will you make money, and how will this make your customers successful?

- How do you create value?

- How do you deliver this value to customers?

- How do you harness this value? (pricing, packaging)

- Is this revenue stream aligned with customer needs and interests?

- Can you align partners with your revenue streams? If you don’t supply what your customer needs, find partners who can. They’ll help you get to market as a multiplier (a win-win).

Milestones and Metrics

Think back to your appropriate Series A milestones. Highlight them here.

Financials

Include a snapshot of important financial information that’s relevant for Series A funding. Be prepared to discuss:

- Simple P&L by quarter (last year, current year, next year)

- Revenue

- COGS

- Gross Profit

- Operating Expenses

- General and Administrative Costs

- Research and Development Costs

- Sales and Marketing Costs

- Metrics

- FTE Headcount

- Bookings (ACV Bookings if a recurring model)

- Customer Count

- Unit Economics

- Customer Lifetime Value (CLTV)

- Customer Acquisition Cost (CAC)

- CLTV / CAC

- CAC Payback Period (in months)

- Net Dollar Retention

→ Review our SaaS Operating Metrics Dashboard to help format and organize your financial info.

Summary

As you wrap up, recap key points. Why is this a great investment? Why do you have an unfair competitive advantage?

Appendix

Remember: Only include the information that will get you to your next step. Everything else? Add it as an appendix.

This could include a cap table, exit potential, customer testimonials, market data backup, or financial assumptions. That gives you the flexibility to pick what you need for each specific meeting.

Over Prepare and Triple Check

Once you prepare your Series A funding materials, it’s time to practice, practice, practice. Make sure you can nail the flow of your presentation. That means thinking through:

- Who will talk about what?

- Who will answer which questions?

- How will you manage handoffs?

Then prepare some more. Think through:

- Where are your weak spots?

- How will you address them?

- How will investors try to poke holes in your pitch?

Consider scripting your answers to these tough questions. Even if you never read them again, it’s a helpful way to organize your thoughts. The key is to over-prepare. While fundraising for his former company Paydiant (acquired by PayPal), “We were rehearsing until midnight every night before a meeting,” says Chris Gardner, Underscore VC Partner.

Once you have your scripts written, triple check that everything threads internally. If you say one thing, but your deck suggests something else—that causes confusion, looks sloppy, and distracts away from your narrative. Aim for meticulous scripts and pitch materials.

In Conclusion

To drive investor FOMO for Series A funding, streamline your process, build authentic relationships with investors (and start early!), target the right milestones, tell a compelling story, and then practice your pitch again and again.

As you go through this process, we’d love to hear from you. What worked? What didn’t? Where could you have used more support? Leave a comment below or shoot us a note at hello@underscore.vc.