Understanding the full fundraising process starts with delineating between nurturing relationships and actively raising capital. At its core, “nurturing” involves two key goals:

- Gather signals from the market. How do investors feel about your space? What types of questions do they have? Where do they see risks?

- Qualify investors as the right fit for you. How will they add value to your company? What will it be like to work with them? Are you interested in them, and are they interested in you?

This relationship-building typically happens over time via a series of touchpoints—not all at once in a first pitch.

In the nurture phase, you’re having a conversation. You’re not pitching investors. “Nurturing is to show momentum and inform them on your progress—not to prompt them to make an investment decision,” says Brian Devaney, Principal at Underscore VC.

How do you do that in practice? It’s about what you share, and how and when you share it.

Effectively Manage Inbound Interest

When you’re raising a Seed round, you want investors to think: This is a really credible team with a unique approach to a big market opportunity. But for a Series A, that reaction shifts to: Wow, there are real data points that show this is working.

Nurturing relationships happens as you gather these proof points, and you don’t want to start actively raising until you have them. That’s why managing inbound investor interest can be tricky.

“It can be easy to enter a process with one or two firms that reach out or get really excited about your business before you’re ready to fundraise,” says Brian. “Be disciplined; don’t succumb to the pressure until your business is past a critical inflection point and you’re ready to kick off a full fundraise.”

You can leverage inbound interest to kick off a process, but only if the timing is right. Until you have the data points ready, feel empowered to punt on the opportunity:

We’re excited that you’re interested. We’re going to kick off our fundraise in X time, and we’d love to share more then.

From there, you can continue to grow inbound interest by showing your progress across these nurture touchpoints.

Focus Your Timeline

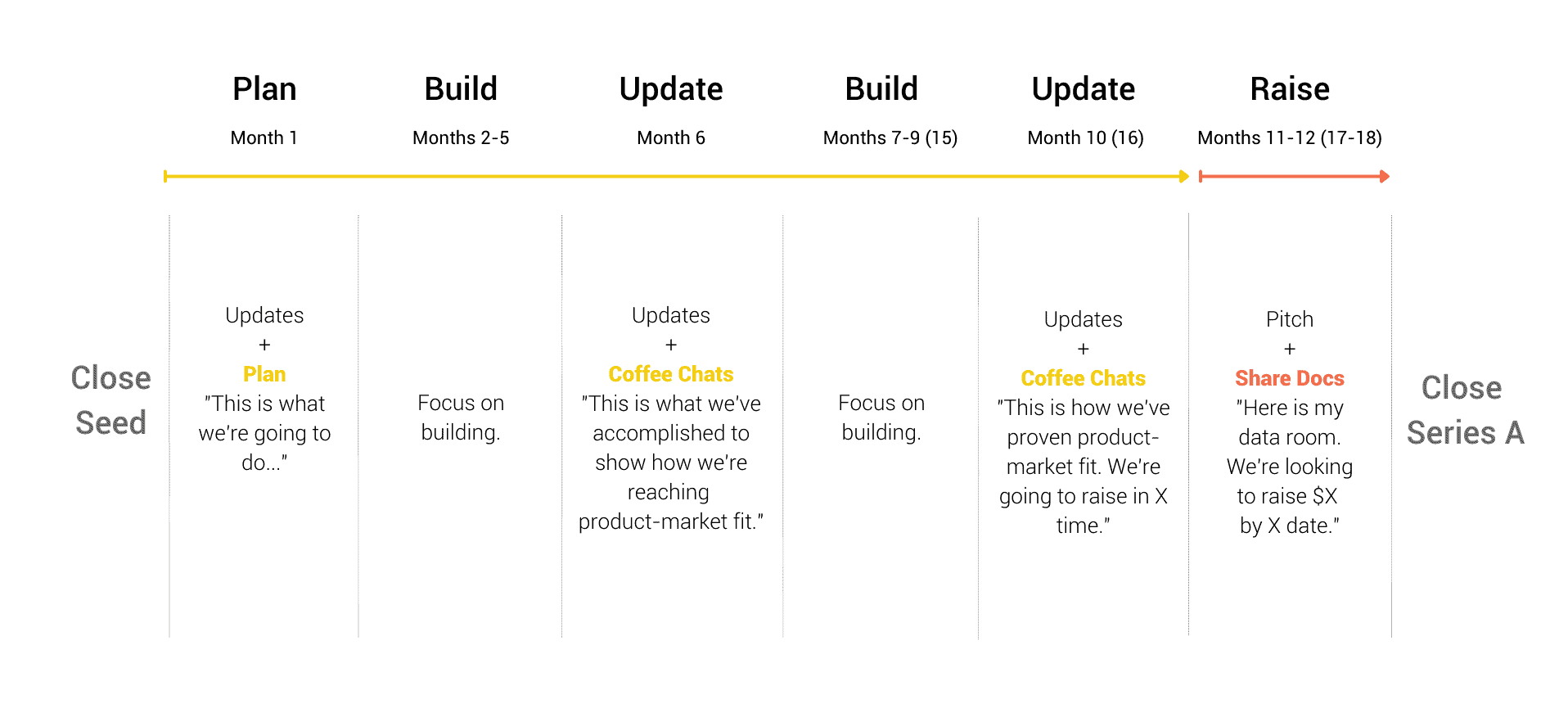

Nurture touchpoints are often spread out between closing a funding round and when you formally kick off your next fundraise (in yellow in the image below). Depending on how much runway you have from your previous round, this could last between 10 to 16 months.

Be sure to queue up your touchpoints to avoid having fragmented conversations along the way. Thoughtfully line up investor check-ins so you can focus on building your company and transitioning into nurturing mode at the right time. This enables you to approach conversations consistently and without distraction in between.  When you do kick off the fundraise, investors will think they have a finite amount of time to review the opportunity and make a decision. The more you can align different investors on the same timeline, the more you can streamline your process.

When you do kick off the fundraise, investors will think they have a finite amount of time to review the opportunity and make a decision. The more you can align different investors on the same timeline, the more you can streamline your process.

Don’t Overshare Information

“Sometimes founders think they’re doing themselves a favor when they share lots of information,” says James Orsillo, Operating Partner at Underscore. “They’re not.” The more details you share, the more opportunities you give investors to make an investment decision—before you want them to.

“Founders who know how to nurture relationships share enough information to keep me interested and show they’re making progress, but they don’t overshare,” says Lily Lyman, Underscore Partner. “They share teasers to control the narrative.”

Startup Secret: During the nurture phase, avoid sharing materials like a financial model, pitch deck, or detailed revenue numbers. Keep it conversational with top-line updates.

Think in Headlines

An easy way to think about these takeaways is to speak in “headlines,” an attention-grabbing statement that shows your progress.

Headlines can be about customer wins, team updates, product improvements—or any critical business theme.

Prep your headlines ahead of investor calls. Write them down so they’re succinct, you get your message across, and you have a record of what you shared.

In one or two sentences each, prepare your headlines to describe:

- The problem you’re solving (and why it’s painful)

- The team you’re building (and why it’s uniquely qualified to solve this problem)

- A milestone refresher (what you said you would do last time you spoke)

- Progress against those milestones (why you’re this much closer to your next inflection point)

- Your next milestones (and why you think they’re the right ones)

“When you actually do what you set out to do and highlight this progress, you show you’re capable of turning your plan into value,” says Brian. “That’s how you prove accountability.”

When you share your next milestones, you can also ask investors for their perspectives:

I’m curious to hear if there’s anything else we should be thinking about, or that you’d want to see before the next funding round?

“Then you have them on the record, too,” says Brian. When you reach back out at that date, you can point to this progress. It then becomes easy to say:

Remember when we talked about these milestones? We reached them, and we’re thinking about kicking off that fundraise.

“This posture is so important,” says James. “You want to control the narrative and control it in a way that gets people excited. Investors will follow your excitement.”

Plus, if you can show huge progress from one check-in to the next, that can help you preempt your next round.

Meticulously Track Your Conversations

Lastly, do not wing these conversations. It helps to remember what you said to each investor, and when. Why?

“We write everything down,” says Lily. Investors are constantly taking notes to map your progress over time. The information you provide must be consistent. When you share milestones, be prepared to meet them.

Plus, if you send materials like financial info, a pitch deck, or customer details, investors will go back and reference your old docs to see if you did what you said you would. “Be able to reference what you shared so you can defend what you missed, too,” says James.

In your investor CRM, jot down your five headlines, note the questions they ask, and upload the version-controlled documents you share.

As you get close to actively raising, tweak your headlines based on investor questions and concerns. And once you’re ready to raise, build a deck that includes all this feedback.