Would you take a billion-dollar buyout? My answer was “no”! Yet, as an Acquia board member, I was happy to vote “yes” last week when Acquia accepted a billion-dollar buyout by Vista Equity Partners. It’s a great outcome. So what’s behind this?

Some context

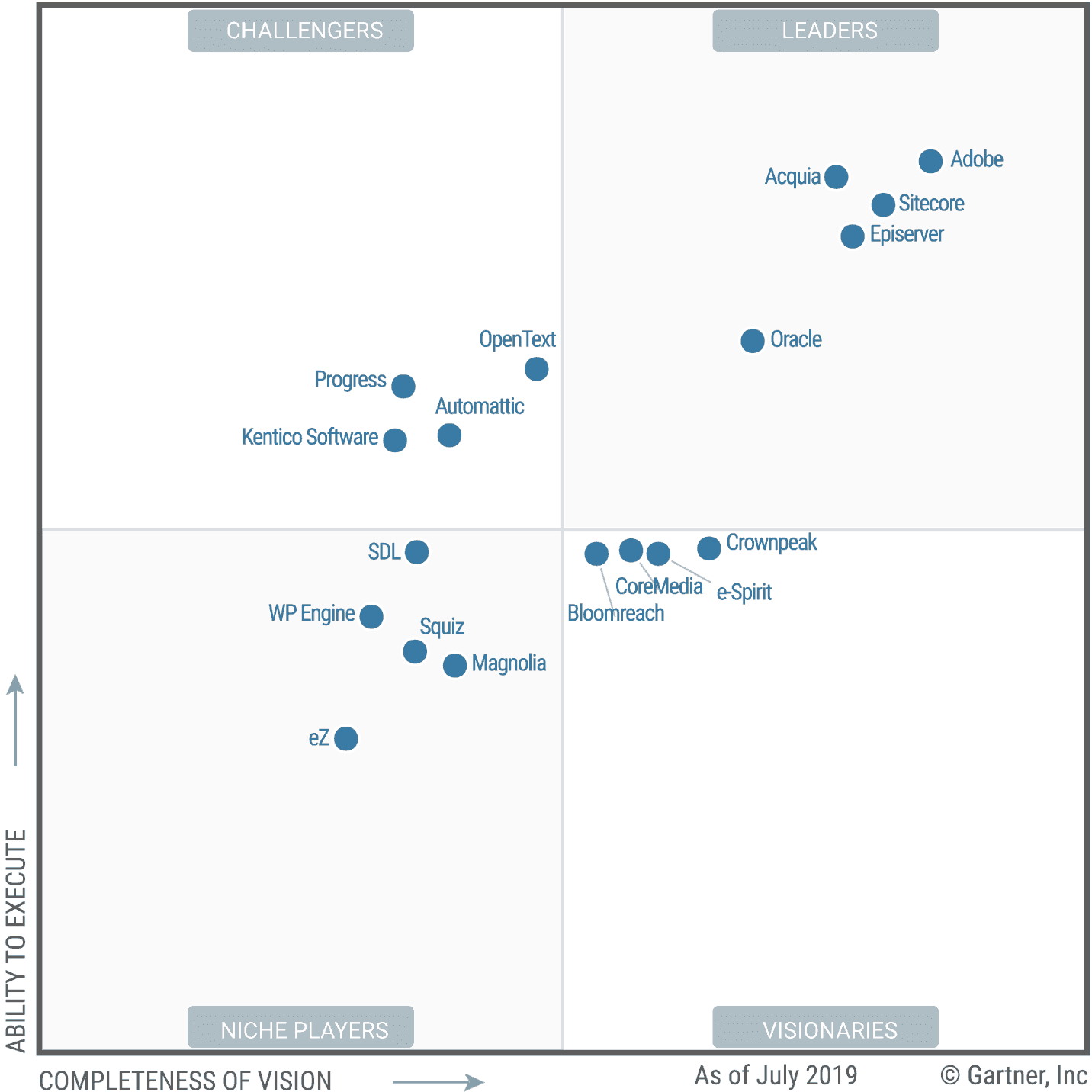

Acquia is a leader in the digital experience platform space.

Acquia already serves 4,000 of the world’s most ambitious brands including 30 of the Fortune 100. So the motivation from Vista was simple. To quote Robert F. Smith, Founder, Chairman, and CEO of Vista

“The world’s leading and most innovative digital brands understand that their ability to deliver a seamless digital customer experience is essential to their success. Acquia understands this and is leading the way in providing innovative solutions to its customers” – Robert F. Smith

Chances are you have already unknowingly touched Acquia’s experience cloud. If you have experienced some of the largest online events like the Olympics or the Grammys then you have come in contact with Acquia.

But Acquia and Drupal weren’t always operating at this scale. Dries Buytaert founded Drupal in his college dorm room. And he and Jay Batson later founded Acquia in my office back in 2007, with our initial seed check of just $250,000.

From left to right: Kieran Lal, Dries Buytaert, Jay Batson, and Barry Jaspan in my office in the very earliest days of Acquia.

They had not even fully spent that seed check before we led their Series A, valuing them at just $5.5m pre-money, pre-product and pre many things they would later build to increase their value more than 160 times!

What are some of the learnings from this?

- It’s all about people. Jay and Dries were awesome founders and they knew to bring in great developers like Barry Jaspan (pictured above) and Community builders like Kieran Lal (pictured above) and later Angie Byron. They also encouraged and welcomed us introducing them to product leaders like Bryan House and a wonderful CEO, Tom Erickson, who scaled the business to north of $150m.

- Scaling is hard. From $0-$1m was really hard. It was even harder from $1-$3m, as we had to figure out a real value proposition. But then the company began to hit its stride, becoming one of the fastest-growing startups. So what’s the key?

- It takes different people at different stages. Outstanding alumni include Chris Comparato (now CEO of Toast, a well known local Unicorn) and Mary Jefts (CFO at the runaway success Salsify). There are SO many others, way too many who deserve mentioning. I’m happy to say they are sprinkled throughout some of the best and brightest startups in Boston and beyond.

- Underneath this, Acquia built a great culture that attracted the best, most diverse, and often distributed team. This fostered both a great work ethic and a fun environment, which when challenged at scale, they refreshed bottom-up, not just top-down.

Acquia’s DNA hanging on the wall of their Boston HQ. Jump in and own it. Do the right thing. Committed to awesome. Give back more. Inspire a little crazy.

But that’s the good stuff. The hard stuff is, well just hard. Along the way, some of the company’s greatest challenges left team members drained and disappointed. And seeing my inbox fill up this week with wonderful messages it reminded me of this saying:

“Success has many mothers and fathers, but failure is an orphan.” – Unknown

At some points, people definitely left us feeling like we were being orphaned, but many like Joe Wykes, who still leads Sales & Channels after 7+ years, or Kent Gale, Acquia’s original support hire over a decade ago, have ignored the noise and focused on customers/partners and delivering value. Thank you to all.

Acquia lives their values through and through, always putting customers and partners first – sometimes even to its own detriment. But, by doing the right thing, Acquia kept it’s grass green, leading some who left to come back to the company – a true testament to their strong culture.

These are great operational learnings, but what was it like as an investor? This can be simply summed up saying “run your winners.”

Run your winners.

It’s been an amazing road to $1bn, but we’re far from done. We like to look beyond valuations and see customer success driving growth, revenues, and profits. As such, I’ve kept all my shares, as has Underscore VC. My partners, like me, believe in Dries’ extraordinary vision, Mike Sullivan’s operational excellence, and the team’s depth. They’ll invest their capital wisely and grow to $1bn in revenue, not just value.

We’re long term investors and we’ve seen this movie before. We watched Salesforce buy Demandware for $3bn at a few hundred million in revenue. Then Jeff Barnett and his team grew it to a billion-dollar revenue Commerce Cloud. When you have conviction, stick with it and run your winners.

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” – Warren Buffett

Embrace change

Looking ahead, if you want growth you’ve got to embrace change for what it is: the fuel for growth. Seek change. Let change become your norm and your ally, or it will crush you. But change and growth don’t need to come at all costs. Profitable business models will persist, while vanity metrics like valuation or hanging on to your old role can kill you. Look no further than the current demise of the We company as an example.

As I mentioned at the start of this article, I said “no” personally to being bought out, but voted “yes” as a board member. I’m now happy to accept my change, which is to leave the Acquia board and remain a supportive shareholder. I’m rooting for Dries and the team as they continue to build an iconic Boston company. A company that has been a great home to those they’ve acquired, like Mautic and Cohesion, and will be a great home to many more to come. Our community is fortunate to benefit from the world-class talent they’re developing and the spinout companies that are sure to come.

Thank you Acquians for the chance to serve. It’s been an honor. Now onwards to your and your customers/partners’ very bright future!