“For a long time, the competitive landscape slide was my least favorite slide to put together,” says Luke Thomas, Founder and CEO of Friday. “It felt counterintuitive; I’m trying to build something different, but I’m putting in all these competitors that I think are fundamentally wrong in some way.”

After a few iterations, he had an “aha” moment—creating this slide is not about defending yourself or complaining about your competitors; it’s an opportunity to spark a conversation to share your unique insights about what makes you different.

“You shift your framing from defense to offense,” says Luke. Why is your company differentiated in a meaningful, defensible way?

Everyone thinks this way, and that’s why they’re building like this. But we think X way, because of Y experience/data, and we’re building Z way.

And that’s not just at this moment in time. When done well, a competitive landscape shows how you will maintain competitiveness over time—not just as a current snapshot.

“How are you going to put yourself in a position to beat competitors in a way that they can’t come after you in the future?” says Richard Dulude, Co-founding Partner at Underscore VC. “How does your lead grow from here?”

Ultimately, it’s less about the slide template and more about the story you tell while fundraising. “You’re informing an investor about the space,” says James Orsillo, Operating Partner at Underscore. “It’s OK to have a vision that challenges the status quo. Set the guideposts for what the market could be.”

In this video, Underscore VC Partner Chris Gardner shares insights into how to talk about your competition in a pitch.

Start With Your Founding Story

Differentiation starts when you tell your founding story.

- Did you use competing products and notice an unsolved problem?

- Did you see companies using products that were missing the mark?

- Why are you building your solution differently?

- How are you creating a unique advantage that way?

Startup Secret: Weave this differentiation into the founding story you tell at the beginning of your pitch.

This helps you get ahead of the conversation. When investors ask you about competition later in the pitch, you can say, “As I was saying in my founding story…” It gives you a huge amount of credibility.

Creating a Competitive Landscape Slide

A caveat: It’s difficult to convey the nuances of your competitive landscape analysis in a single slide. It’s made to be supported with a voiceover in your pitch. But you still need a slide to reference.

When illustrating your competitive landscape in a slide, we see four common approaches: (1) the 2×2, (2) the Venn diagram, (3) the feature matrix, and (4) the ghost (when it’s not included in a pitch at all). The examples below are modeled off real competitive landscape slides that we’ve received.

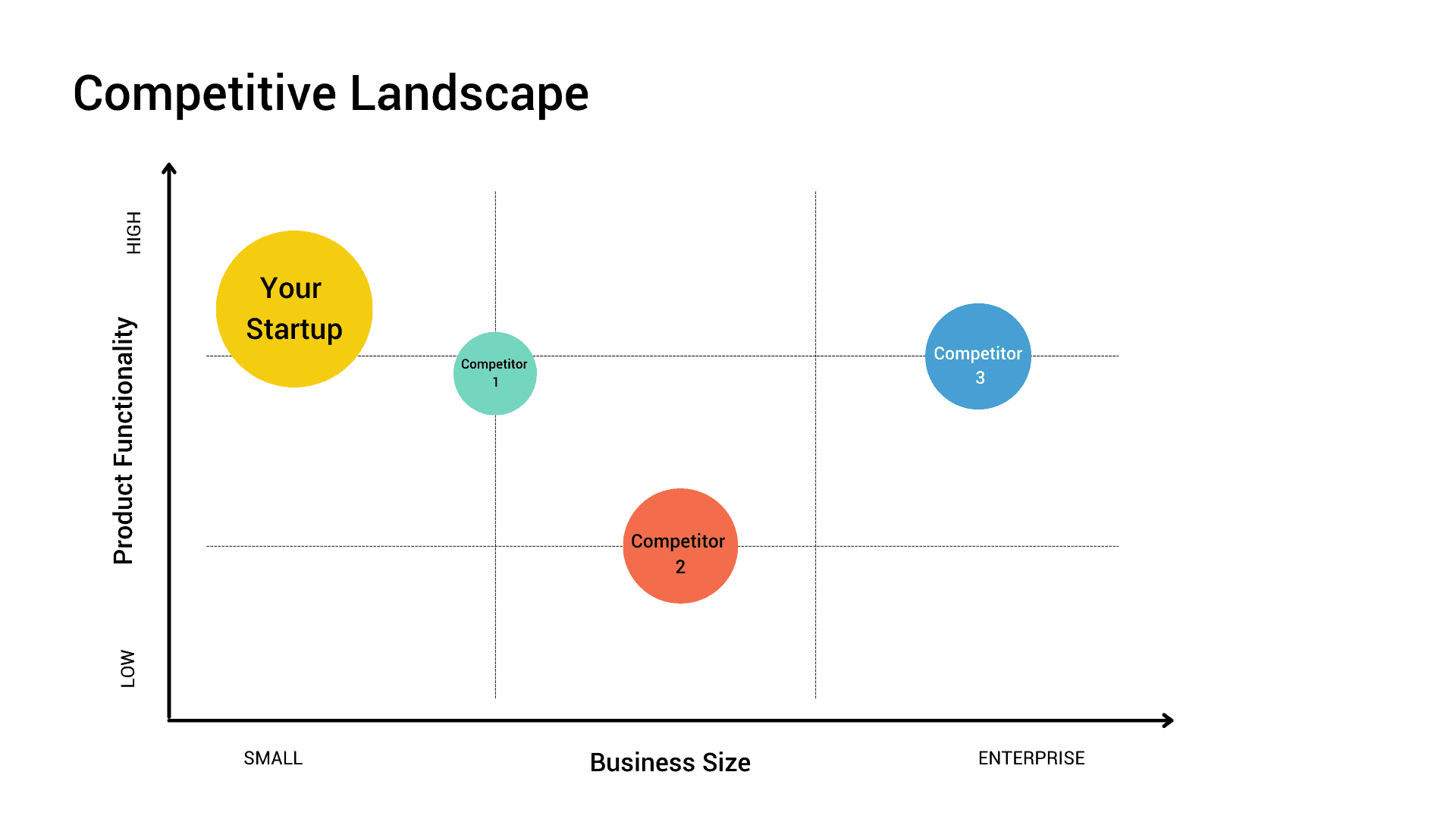

The 2×2

One of the best ways to illustrate your competitive landscape is through a 2×2 chart. The 2×2 shows that you have a good command of all the competitors in your market, and it conveys how you’re different from them. And when you select unique, compelling axes, it demonstrates why you’re going to win on a few simple vectors.

“The best 2x2s use the axes to convey what competitors could never do,” says Richard. “They show how they have the right to win because of their specific advantages, whether that’s through a business model, data advantage, product structure, or something else.”

But unless thoughtfully crafted, it’s easy to fall back on “useless axes,” says Richard. That’s what makes a PowerPoint template difficult to create for this slide—it’s the unique axes that matter, not the chart.

In the example below, “product functionality” and “business size” are both quite generic. The axes need to go a step further to dig at the real reason they are differentiated.

Why couldn’t these competitors expand product functionality? Why do small businesses need additional functionality? Why have these competitors decided not to target small businesses? What prevents them from shifting up or down market and taking more of your market share?

Why couldn’t these competitors expand product functionality? Why do small businesses need additional functionality? Why have these competitors decided not to target small businesses? What prevents them from shifting up or down market and taking more of your market share?

To avoid useless axes, think through:

- What aspect of your product is the stickiest?

- Can these competitors compete on this axis?

- Can this competitor cross this axis? What would that take?

- Why do your customers need this differentiator?

- What are you intentionally not?

- Are there other competitors in your quadrant? If so, how else are you different?

- Is your product better for a certain segment than another competitor?

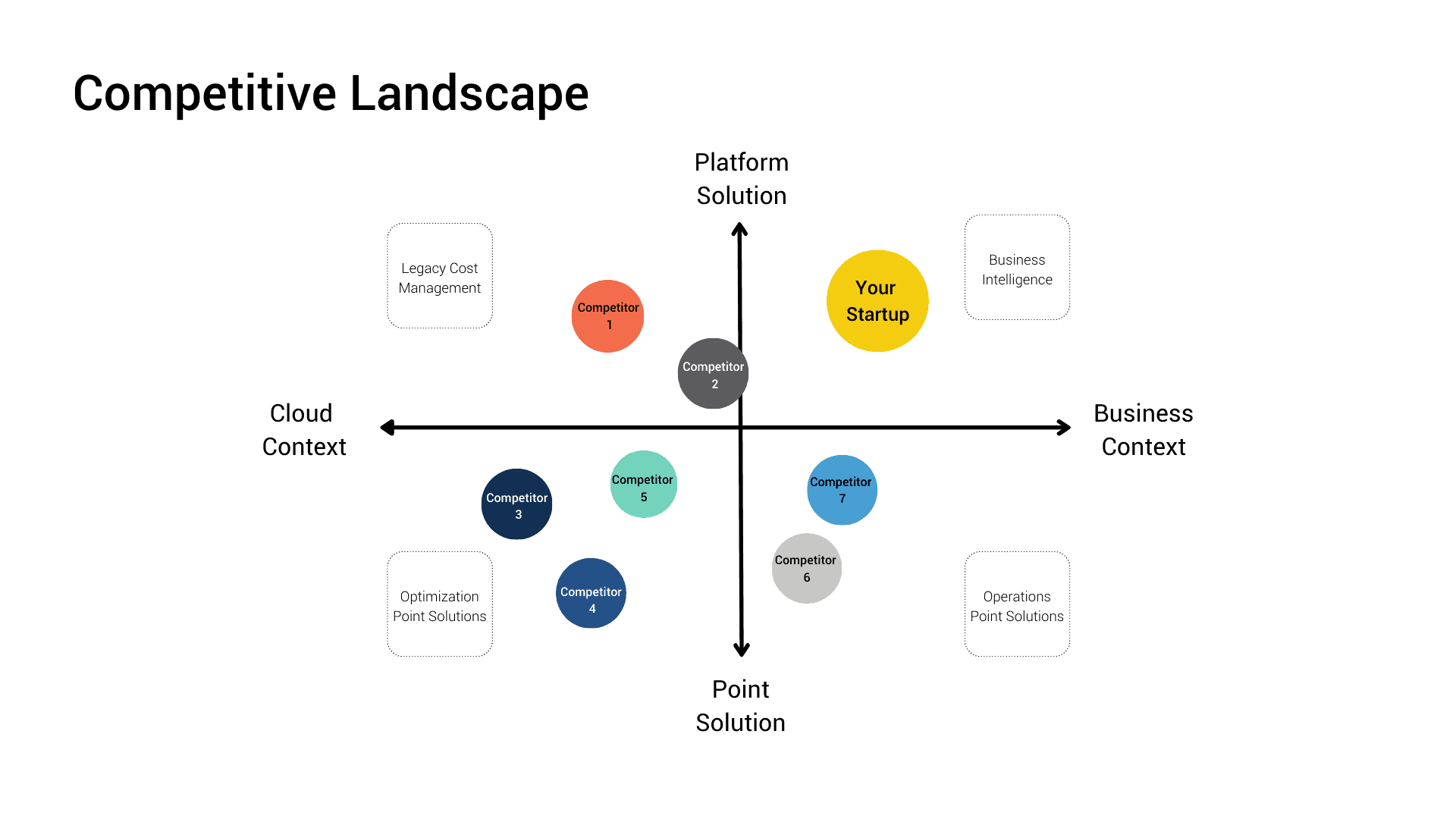

The example below is more specific, includes more competitors, and summarizes the quadrants. With all these details, it’s more useful.

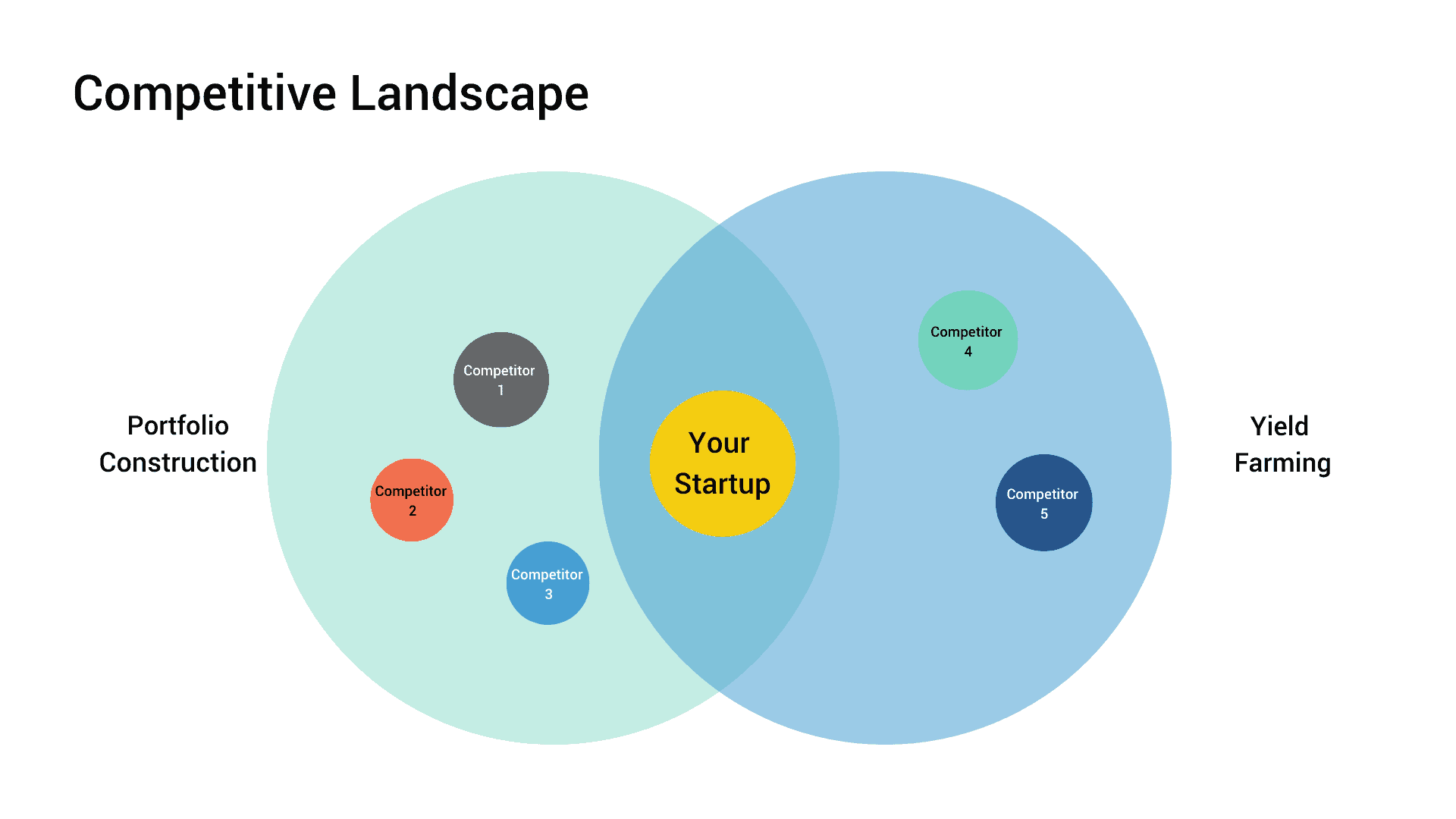

The Venn Diagram

Another common—but less effective—way to illustrate a competitive landscape is through a classic Venn diagram, where different competitors are placed in two different spheres and your company sits at the intersection.

While this format does outline your competitors, it doesn’t show why you’ll win against them.

“These slides are often confusing,” says Richard. “Why would I invest in a company with so many adjacent competitors—and without a clear understanding of why they wouldn’t enter your space?”

“You’re sort of like this one, and you’re sort of like this one, so all of them could go after your business,” says Richard. “You’re in the firing line of all of these other competitors.”

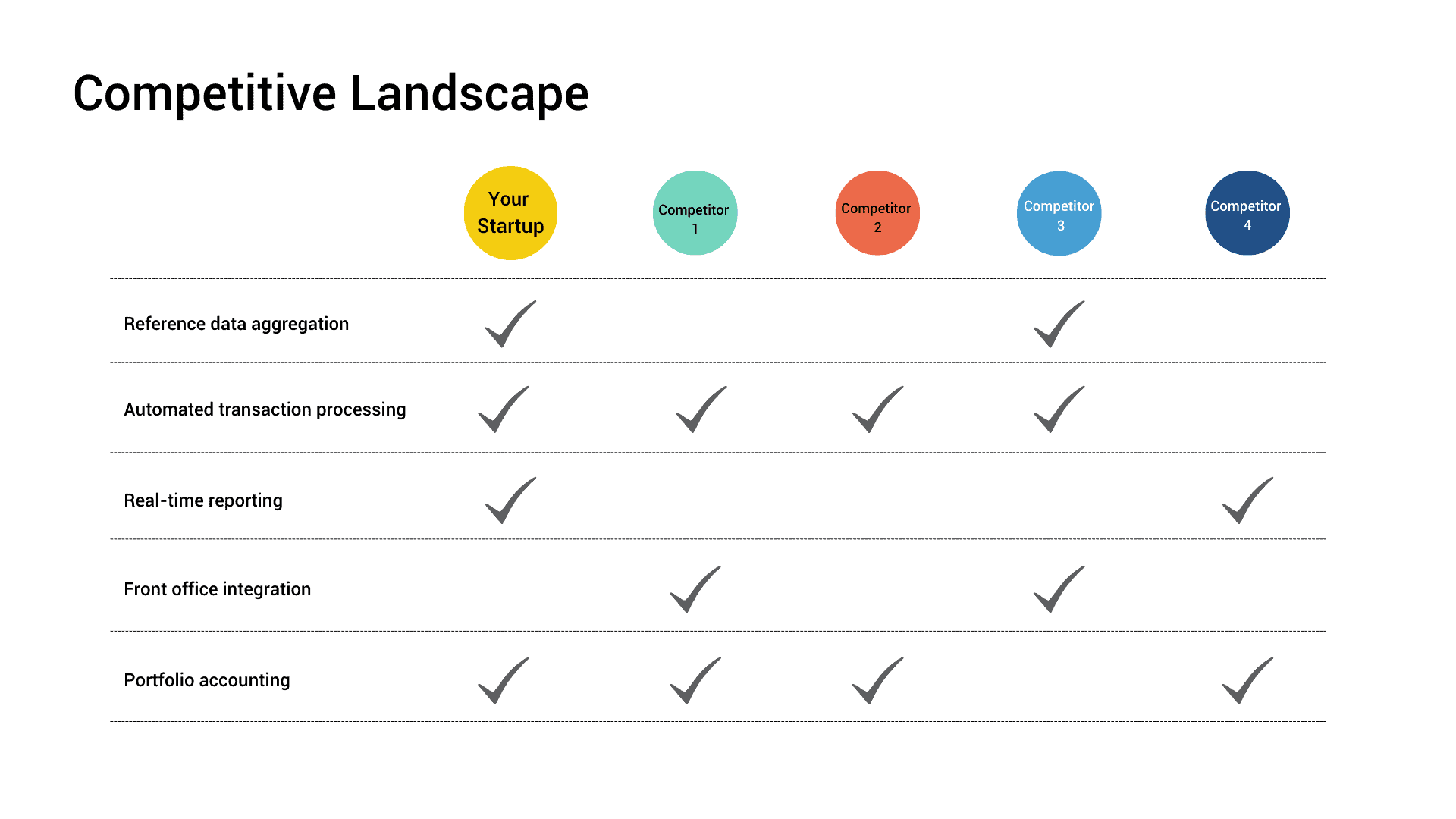

The Feature Matrix

Another common way to convey the competitive landscape is through a feature matrix. While it does outline top competitors and their attributes, it often simply turns into a long list of features—without prioritizing differentiators.

We recognize that prioritizing important dimensions can be challenging. “But it becomes a catch-all slide,” says Richard. “Without prioritizing them, the slide loses its meaning.”

Several of these dimensions might be important. “But at the end of the day, there are usually only one or two attributes that enable a company to win in the long term,” says Richard. “I want to know how you’re going to be different as time goes on.”

Which attributes will you really lean into and build your advantage around?

The Ghost

Last, we see the occasional deck that simply does not include a competitive landscape slide.

To name it, if you email a pitch deck directly to an investor without talking through it to share additional context, there is a risk that an investor will misinterpret your competitor analysis and pass on your startup. But not acknowledging the competition can be far worse.

“With the exception of nascent markets, if founders say, ‘No one else is playing here, or everyone else is so far away,’ I immediately think you’re either ignoring part of the market or you don’t know it,” says Lily Lyman, Partner at Underscore. “Neither of those are positive.”

How to Tackle Common Investor Objections

When pitching and outlining your competitive advantage, you’re inevitably going to face skeptical investors. Do you have good insight into the problem? What about your opinion is different?

A Crowded Market

“A crowded market is one of the most common reasons investors dispel a pitch,” says Richard. “It’s a cop-out for a lot of VCs.” Don’t let investors “lazy pass” on you.

It’s OK to be in a crowded market (in tech, which market isn’t crowded?), but you have to be able to clear the noise and talk about why you have a market position that no one else is taking. “The noisier it is, the more important that becomes,” says Richard.

Especially if there are several other venture-backed companies marketing a solution to the same problem—you need to make it clear why you’re both 1) different and 2) correct.

That could come from a unique insight on your go-to-market strategy, target customer, product differentiation, pricing, or specific industry needs you’re targeting. “Whichever it is, you need to make it abundantly obvious to the investor as soon as possible,” says Brian Devaney, Principal at Underscore.

This is also where getting introductions to VCs from existing connections can be helpful. In their initial ask to the investor, they can call this out up front: “Unlike others in this industry, X is taking a unique approach because of Y.”

A few tactics to approach a crowded market include:

A Strong POV

Why is your competitor’s approach incorrect? What are their similar products missing? Why does this whitespace exist? What lived experience can you draw on?

Everyone else believes the problem/correct solution is X, but we believe it’s actually Y.

Even thesis-driven investors want you to know more about the market than they do. “You’re the expert; show it,” says Brian.

A Unique Segment

What is your minimum viable segment within your target market? Is this segment being ignored? If so, why? How big is it? How will you go after it over time? You can build for a certain market segment (like SMB), but you have to explain why enterprise solutions aren’t coming down market.

Fresh Competitor Insights

What can you teach an investor about the people they think are competitors? Have you talked to people who have used those competitors? Can you name their pain points?

“We’re impressed when a founder has a much better understanding of the competitors we know,” says Brian. “In fact, they should!”

Adjacent Competitors

Often, there will be adjacent competitors that could do what your company is doing. And if they aren’t doing it yet, why won’t they tomorrow, next week, or next year?

Especially if there’s a well-capitalized close adjacent competitor, “Is there a gorilla in the room that’s going to smash you to bits?” says Richard.

Sometimes people talk about the Facebooks and Googles of the world, the big market players, but adjacents need not be market leaders.

This discussion could be around feature overlap. Is your company providing a feature of someone else’s vision? It’s easy to get caught in a trap of having a meaningful value prop, but that doesn’t necessarily mean you can build a defensible company around it.

Why should yours be a standalone company? The stronger your unique POV or lived experience around this, the better.

Missing Competitors

“VCs shouldn’t know more than the entrepreneur about a respective market,” says Richard.

So if you present a market that an investor knows well, and they notice certain competitors aren’t listed, that’s concerning. “It makes me question if they can really win in this market,” says Richard.

Triple check that you’ve got them all in your presentation template and can speak to each competitor.

A Simple Reminder

Last but not least: “An investor could have an opinion on the market, and that opinion could be wrong,” says Brian. If that’s the case, prove it! Pull your experience, wisdom, and proof points together in a compelling presentation slide and tell a succinct story around it. Your pitch will be that much stronger.